2017: What’s Next for Solar in Europe?

Friday, 10 February 2017

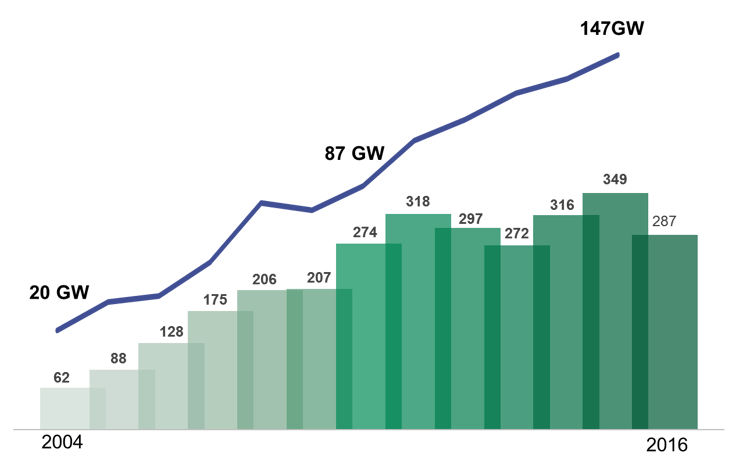

While the outlook in Europe wasn’t quite as optimistic as it was in the emerging markets, the region had its own achievements to celebrate with 100 GW online.

- Published in News

Panama Energy Sector: Overview of Incentives

Wednesday, 08 February 2017

As part of Panama’s strategy to diversify the country’s energy matrix, the Panamanian Government has enabled incentives for renewable energy projects.

- Published in News

Siemens Wind Power: Wind Markets in Asia

Monday, 06 February 2017

Green Dealflow interviews Alexander Gamborg, Siemens Wind Power, Onshore Asia Pacific.

- Published in Useful Tools

Business Opportunities in Wind Energy in Asia

Friday, 27 January 2017

Edgare Kerkwijk (Board Member in Asia Wind Energy Association) about the business opportunities in wind energy in Asia.

- Published in News

What happened in the renewable energy world in 2016 and its meaning for Enel Green Power

Tuesday, 24 January 2017

New investments, record prices at auction, the ups and downs in the prices of fossil fuels, company acquisitions, a new legislative proposal along with..

- Published in News

Portugal has every right to dream big in a new age of Solar

Monday, 23 January 2017

As fund managers and investors look at rubble of the old dinosaur of the European solar market, they shouldn’t rush to switch industries.

- Published in News

Google: Achieving Our 100% Renewable Energy Purchasing Goal

Friday, 16 December 2016

In 2012, Google made a commitment to purchase enough renewable energy to match 100% of our operations, and we are excited to announce that we will reach that goal in 2017.

- Published in News

3 Things Successful Renewable Energy Investors Do Differently

Friday, 16 December 2016

Green Dealflow recently concluded a series of interviews with some of the market’s most successful investors.

- Published in Green Dealflow, Useful Tools

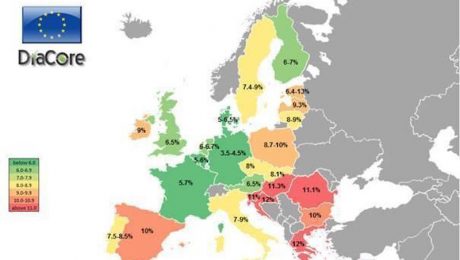

Onshore Wind WACC in EU

Thursday, 06 October 2016

In 2014 the CEO of Green Dealflow, Kenn Righolt, participated in the survey about onshore wind WACC in EU. See the results here.

- Published in Green Dealflow

€500bn European Infrastructure Development Initiative – Will National Governments Do Their Part?

Friday, 23 September 2016

The European Commission has recently announced its intention to boost support for infrastructure investment in Europe. We examine how the support mechanism works and who benefits.

- Published in News

Understanding Record Low 2.44US-cents/kWh Solar Bid in Abu Dhabi

Friday, 23 September 2016

Understanding Record Low 2.44US-cents/kWh Solar Bid in Abu Dhabi

- Published in News

Power Transactions and Trends, Q2 2016

Thursday, 25 August 2016

Quarterly deal activity within the power and utilities sector and forecasts that the trends will shape future M&A activity.

- Published in News

The Year of PPAs and the Corporate Green Agenda

Wednesday, 03 August 2016

Providing analysis on each of our global regions, adoption trends, growth areas and specific examples of renewable energy PPAs.

- Published in News

EU Energy Sector: 10 Investment Trends for 2016

Wednesday, 06 July 2016

EU Energy Sector: 10 Investment Trends for 2016

- Published in Useful Tools

Corporate PPAs – Market Trends and Opportunities

Thursday, 23 June 2016

Corporate PPAs - Market Trends and Opportunities

- Published in Useful Tools

Renewables 2016 Global Status Report

Monday, 06 June 2016

Read the highly-recommended global status report of renewables in 2016 by REN21.

- Published in News

Improving Wind Project Profitability

Thursday, 26 May 2016

Banks will usually focus on EPC contracts to reduce risks forcing manufacturers to expand scope beyond core competencies and increase project risks.

- Published in Useful Tools

The Rise of Corporate PPAs

Monday, 23 May 2016

The economic and environmental advantages of corporate renewable PPAs and a closer look at some of the biggest deals recently completed by corporates.

- Published in News

Free Report: Renewable Energy in Latin America

Monday, 23 May 2016

Guest post by Simon Currie – Partner and Global Head of Energy at Norton Rose Fulbright. In 2014 alone, global investment in renewable power and fuels totaled US $270 billion, with more than half of this occurring in emerging markets and a significant proportion directed to Latin America. Click below to download the report on

- Published in News

The New Reality of Green Energy

Wednesday, 18 May 2016

Renewable energy investment is on the move. In a world where the global investment landscape for clean energy developing is fast being redrawn.

- Published in News

Top 25 Largest Solar PV Projects in The Netherlands

Wednesday, 18 May 2016

With this article we want to provide an overview of the Dutch utility-scale solar market, which will be based on a comparison between what currently are and previously were the country’s largest solar pv projects. Looking at this table, there are several things to highlight. The first noticeable fact is that the total size of the

- Published in News

A Market Approach for Valuing Renewable Energy Assets

Monday, 09 May 2016

Guest post by Steffen Lück – Assistant Director at Deloitte Denmark. At Deloitte, we have recently released a new update on our articles on valuing wind farm and solar PV farm assets. The analyses now totals 556 transactions on renewable energy assets worldwide and reveals how capacity in different project stages affect the enterprise value

- Published in News

Investing in the Greek Wind Power Sector: Ten Things to Know

Thursday, 28 April 2016

Guest post by Dimitris Assimakis, energy and projects partner in the Athens office of global law firm Norton Rose Fulbright. Introduction Greece enjoys a remarkable wind resource with local average wind speeds (at hub height) often exceeding the 8–10 m/s, especially in the Aegean Sea islands and on mountain ridges on the mainland. Its 2020

- Published in News

Opportunity is Knocking in the Renewable Energy Space in India

Wednesday, 30 March 2016

Guest post by Umang Goswami – an energy sector specialist with 12 years experience with the World Bank, Commercial Banks and most recently was heading a silicon valley solar company’s finance office in India. He is looking to setup a holdco to buy the type of assets mentioned below through collaboration with a fund in

- Published in News

5 Ways to Fail When Raising Money for Your Clean Energy Project

Monday, 28 March 2016

Jigar Shah: To ensure the best people and projects are securing the capital they deserve, here are 5 actions for clean energy entrepreneurs to avoid.

- Published in News

Professional Operations and Maintenance: Protecting PV Plant Profitability

Friday, 04 March 2016

Photovoltaic (PV) solar plants have emerged as much-desired assets drawing experienced investors looking for steady, reliable returns. But what is it that investors look for, or should look for, before considering a PV project? What Investors Look For in Solar PV Projects A quick straw poll would probably point to technology being the key differentiator.

- Published in Useful Tools

How Using Green Deal Flow Can Increase the Price of Your Project

Thursday, 04 February 2016

Your Previous Buyer Is Not Necessarily the Right Buyer for Your New Project Many sellers of renewable energy projects have access to one or more buyers with whom they have done business before. However, your new project may be different from your last one. Eventually, your new project may be located in another country, or

- Published in Useful Tools

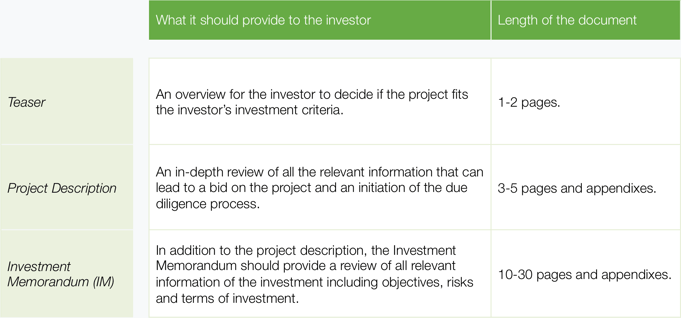

How to Present Your Renewable Energy Project to Investors

Wednesday, 20 January 2016

How you should present your renewable energy project depends on several factors: Is it the initial presentation, or is it one for a later stage of the negotiation? What type of investor are you presenting to? What is the development stage of your project? What is the size of your project? Essentially, the presentation should take into

- Published in News

Financial Investor: Is Your Strategy Clear?

Sunday, 10 January 2016

Financial Investor: Is Your Strategy Clear?

- Published in Useful Tools

Matching a Renewable Energy Project with the Ideal Investor

Saturday, 02 January 2016

Matching a Renewable Energy Project with the Ideal Investor

- Published in Useful Tools