Guest post by Umang Goswami – an energy sector specialist with 12 years experience with the World Bank, Commercial Banks and most recently was heading a silicon valley solar company’s finance office in India. He is looking to setup a holdco to buy the type of assets mentioned below through collaboration with a fund in the renewable energy space.

The Indian energy landscape has changed dramatically in the last decade

In 2004, the energy mix consisted of about 3-4% renewable energy while the rest was coal and fuel fired sources. In 2015, the energy mix consists of 29% renewable energy – a mix between solar, wind and hydropower projects.

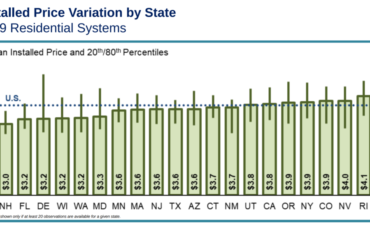

Out of the total operational capacity, thermal energy’s installed capacity stands at 168GW, hydropower at 40.5GW, solar at 4.8 GW. Solar has about 8-9 GW under construction from current developers in different states. Solar will definitely be one of the main sources of electricity in coming years.

New opportunities are suddenly arising

In the renewable energy market, this spectacular growth has led to a new opportunity suddenly arising. Some of the developers in the solar space in India like Welspun and Sunedison, who have over 2 GW installed capacity between them, have been trying to dispose of their assets to get rid of debt or de-risk their balance sheets.

These are brown-field projects with IRRs (returns) of anywhere between 14-18% (In Rs.), operating with 20-25 year PPAs signed with governments. The construction risk is over, funding has closed and the projects are delivering electricity. The situation is similar for some hydropower projects run by other developers such as JP Industries, who are looking to sell assets.

Slowly but surely international players like TPG and JC Flower & Co are setting up structures in India to look at assets. In the renewable energy space, this is an opportunity for players to develop a portfolio of these long term assets with stable revenue streams.

Best regards,

Umang Goswami