This week, Green Dealflow published its monthly transaction activity report of the solar and wind industries for August (access it here). The report is built from Green Dealflow’s transaction database that tracks equity transactions of solar and wind projects around the globe. Altogether the month of August has been slow as compared to July both in terms of the number of transactions and total capacity transacted in solar and wind transactions. We captured 42 solar and wind deals overall mounting to 4.8GW (gigawatts).

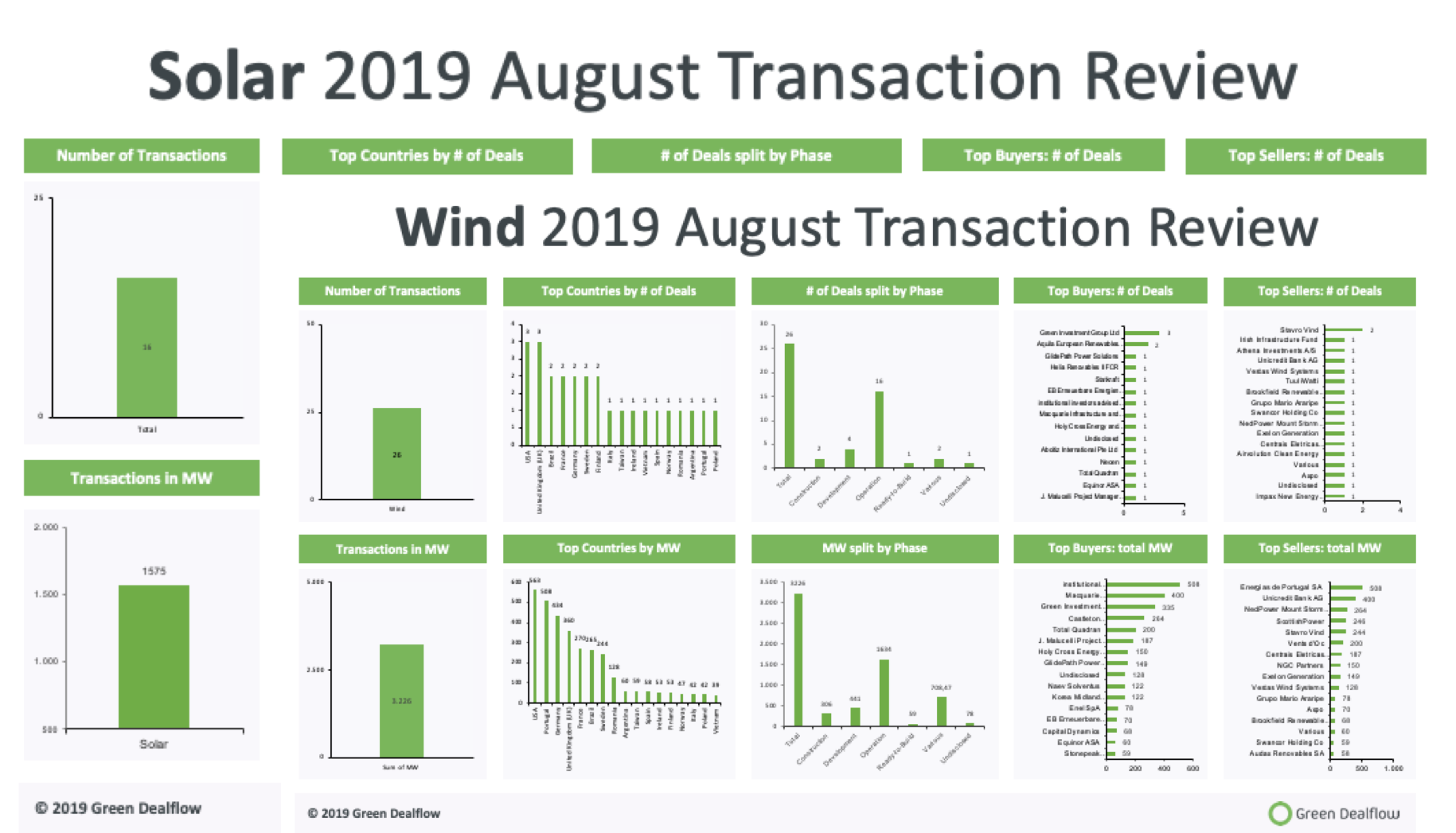

In the solar industry, the report records a total of 16 transactions amounting to more than 1.5GW in gross capacity transacted. As compared to a busy July with 23 transactions amounting to more than 7.1GW, August was a quite slow month regarding both the number of transactions, and MW transacted in solar energy deal flow.

Different than last month, the US was in the leading place regarding total MW transacted with transactions amounting to 542MW. The leading position of the US was mainly due to Capital Dynamics acquiring the 180MW Townsite Solar Project in Nevada from Skylar Resources. The Townsite project also features a 90MWac / 360MWh energy storage facility which will be one of the largest in the world. Australia followed the US mainly due to the transaction of AC Renewables and UPC Renewables jointly investing in the 300MW Bridle Track solar farm in South Australia.

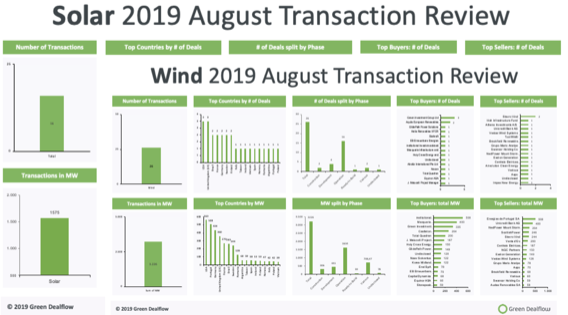

In the wind industry, the report records a total of 26 transactions amounting to 3.2GW in gross capacity transacted. As compared to a busier month of July with 5.5 GW in 21 transactions, August was 41% less active regarding MW transacted in wind energy deal flow.

The US was again in the leading place regarding total MW transacted with transactions amounting to 563MW. This was mainly due to Castleton Commodities International LLC acquiring NedPower Mount Storm LLC, a wind project of 264MW in Grant County. The project, which sells its renewable energy into the PJM market, was completed in 2008 by Dominion and Shell. Portugal was in the second place due to EDPR completing the divestment of its interest in a 997MW European wind portfolio. The transaction concerned 388 MW of French wind farms as well as 348 MW in Spain, 191 MW in Portugal and 71 MW in Belgium. EDPR’s 51% stake in most of these plants translates into a total net capacity of 491 MW.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.