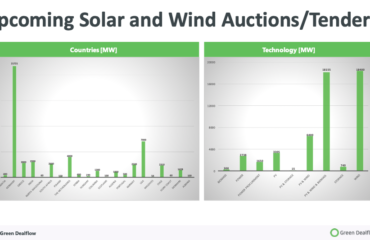

Another month, another transaction review published by Green Dealflow: the transaction activity report in the solar and wind industries for the month of March, built by our analysts is available here. The report is based on our transaction database, which tracks equity transactions of solar and wind projects from around the world and it is possible for you to have an insight into where the market is going. Also this month you can find the tracked Tenders & Auctions announced worldwide for Solar and Wind technology, which you can download here. This new feature can help our followers to prepare their strategy and the next moves in the market, having an overview of the future governmental inputs in the Renewable Energy market.

March 2021: The number of transactions for the overall market counts for a total of 33 transactions, amounting to 4.6 GW, surprisingly a decrease in the capacity transacted, but keeping up the good work with the same number of deals signed, compared to the last month. We interpret this element as for describing a busy market, with an appetite of investors and developers for projects, also small ones, in order to power more people and secure the provision of green energy. The right momentum to invest and develop is also highlighted by the several new instruments put in place by countries: incentives and regulations are allowing more and more projects to flourish, as well as different new technologies are being mainstreamed and implemented, offshore, agri-voltaics and floating pv.

But let us move on to the solar and wind markets and their performance in March.

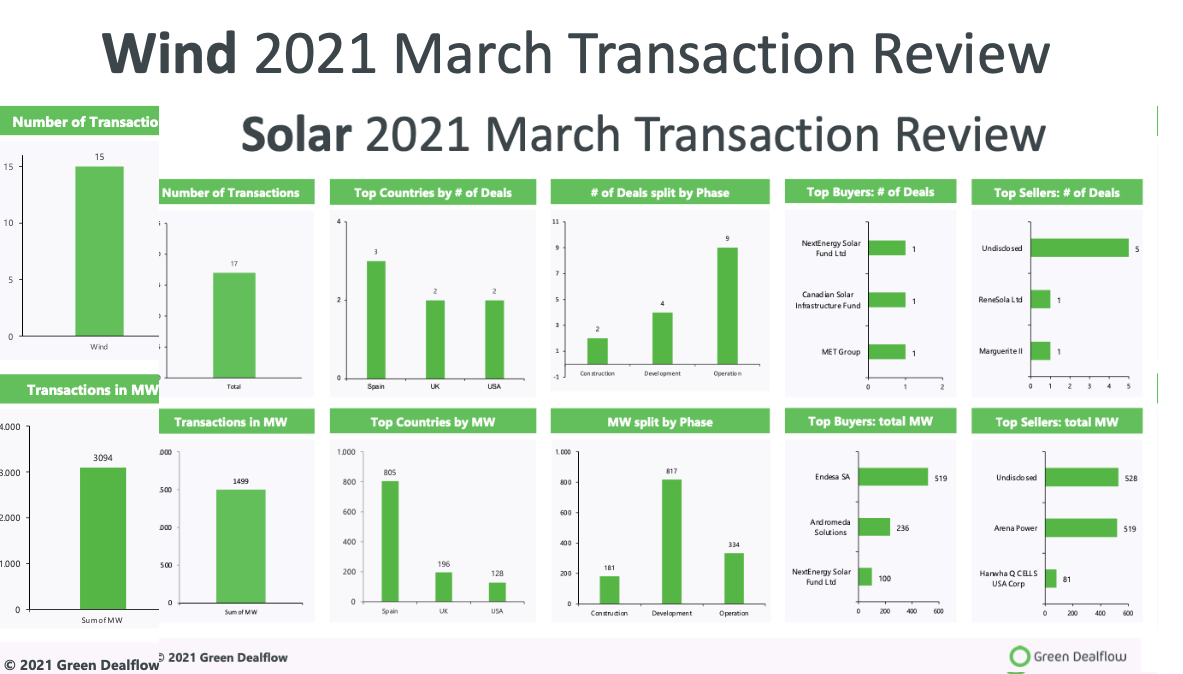

The solar industry performance this month is reaching a total of 17 deals, with an overall capacity of 1.5 GW. Among the most active countries, Spain gets the first step of the podium, followed by the UK and the U.S.

Among the most relevant acquisitions, the Spanish energy utility Endesa SA announced the deal signed for a portfolio of 519 MW of solar photovoltaic (PV) projects located in Huelva province, southern Spain. The project comprehend a cluster of 11 solar farms stretching across six towns in Spain’s southwestern province. These will serve several industries in the area.

This March was very busy for the wind industry! for 15 deals signed, the capacity reached amounts for a total of 3.1 GW suggesting a decreasing trend in the activities of this month, but with exciting deals signed by the top players in the market.

But let us start from the top countries, Poland and the U.S. are the leaders this March, followed by Scotland and Sweden. The presence of these countries as players this month, comes from the recent developments in regulations, which are promoting the development of wind, especially for Poland ( one of our focus markets) and Scotland.

Among the most relevant deals signed comes from the Northern Sea, Hornsea 1 Limited, a joint venture owned by Ørsted (50 %) and Global Infrastructure Partners (GIP) (50 %), announced the sale of its assets to Diamond Transmission Partners Hornsea One Limited (‘DTP’). Hornsea 1 is an offshore wind farm in the UK, approximately 120 km off the Yorkshire coast. The 174 Siemens Gamesa 7 MW wind turbines with an overall capacity of 1,218 MW, will power more than one million British homes.

We are off to a great start in 2021, we can already see the movements in the market thanks to the countries pushing on with the green deals. We are in a hot spot in the green transition. Follow us for more exciting news!

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.