The transaction review for the month of July has been published by Green Dealflow: the full dataset for solar and wind transactions closed in the last month is available here.

The report allows seeing the market behavior by a detailed overview of the country´s activities. In addition, the Tenders and Auctions announced worldwide to invest in clean technologies can be downloaded here. This information is captured by our analysts and can provide substantial support for defining an investment strategy.

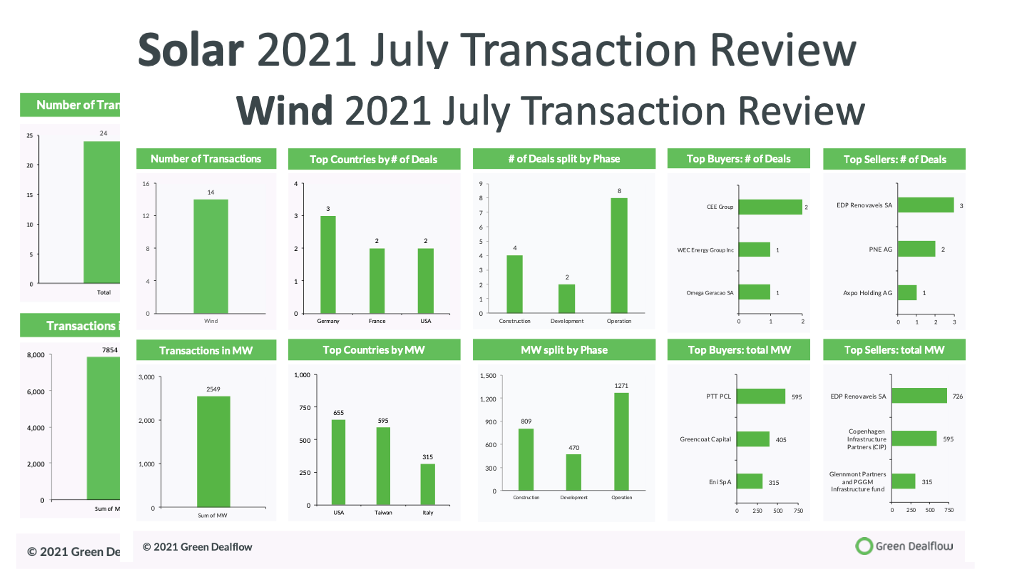

The month of July has seen a total of 38 deals, with a total capacity transacted of 10.503 MW, more than doubling the deals but almost halving the capacity transacted in the month of June. To be updated on some of the most active countries in the energy transition, like the UK, Ireland, Italy, and the Baltics, you can find some insights by reading our blog articles here.

This month, the solar industry´s performance reached a total of 24 deals, +33% compared to the last month, with an overall capacity of 7854 MW. The U.S. still gets the gold medal for the number of deals in the solar industry, followed by India, Denmark, Ireland, and Spain.

The most significant solar and solar plus storage project acquisition involves Enel Green Power North America, buying a total DC capacity of 3.2 GW from Dakota Renewable Energy in the Mid-Atlantic, Midwest, and the Western US. It continues the race of the company through development-stage solar projects and hybrid power plants in the States. Another relevant deal was signed between Azora and the Italian colossus Eni SpA, acquiring 1.2 GW split between 1 GW of solar and 230 MW of wind, all located in Spain. “This operation allows us to reinforce our growth prospects through a pipeline of solar projects in a strategic market like the Spanish one”, said Claudio Descalzi, CEO of Eni.

In July, the wind industry accounts for 14 deals signed, with a total capacity of 2549 MW, -36% compared to June, but still, an increase compared to the transacted capacity in May.

The most relevant deal saw PTT unit Global Power Synergy PCL join the Changfang and Xidao project in Taiwan, acquiring 595 MW of offshore wind sold at 25% interest by Copenhagen Infrastructure Partners (CIP), who bought the project in 2017. The second-biggest deal involved Greencoat Capital, finalizing the acquisition of a 68% equity stake of the Bright Stalk and the Harvest Ridge wind farms in the US, sold by Madrid-based EDP Renovaveis SA for a total of 405 MW.

Stay updated and follow us for many more new insights!

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.