Energy storage is going to be one of the most important technologies in the shift toward clean energy systems.

Because solar panels and wind turbines don´t operate continuously due to the intermittency of solar radiation and wind currents, the owner of these projects are forced to sell the electricity when these resources are available, and not when the value of electricity is high. Energy storage can inject the intermittent energy stored previously into the grid also when the sun is not shining and the wind is not blowing.

Solar projects are the most suited for a storage project because of the predictability of their output given by sun hours. During the daytime, the electricity prices tend to peak, and with a storage project, it is possible to sell the electricity when the price is high, even if panels aren´t producing a lot.

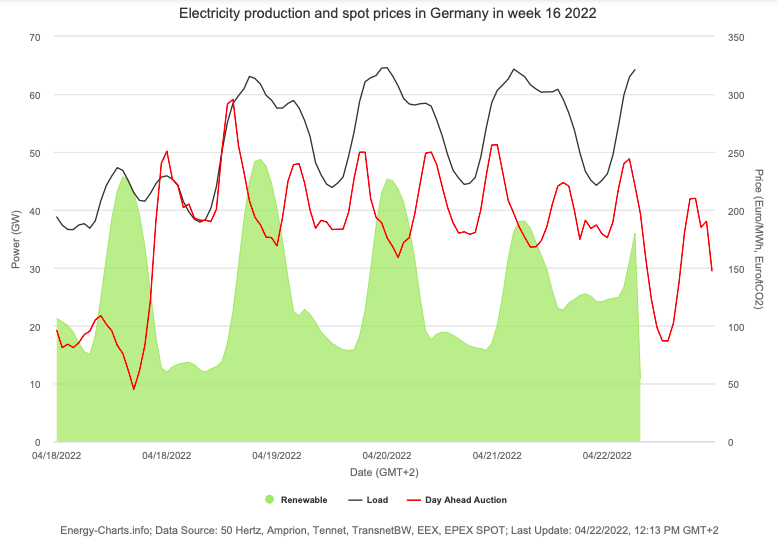

The cannibalization effect is probably the number one reason why a storage project will shield a solar plant from losing its market value. This effect describes how the revenues of solar plants decrease with the overall increase of solar generation in the grid: when more and more solar plants are producing during the day, low-cost supply increases, reducing the clearing price for the whole market. This causes lower revenues for solar plants the more solar energy is generated at the same time throughout the day.

Grid flexibility will also become vital as more and more variable renewable energies will participate in the market. The value of capacity able to mitigate rapid output variations will increase. According to the International Energy Agency 2030 NZE scenario, the share of system flexibility provided from batteries will increase from 0.2% in 2020 to 6% in 2030, but more efforts are needed in this direction.

Therefore participation in the reserve and in the balancing market will constitute additional revenue streams crucial to exploiting the potential of a storage facility.

Alternatively, the new capacity markets introduce the possibility of signing a long-term contract with TSOs that rewards the availability of electrical power for a fixed number of hours during the year, even when profitability is not guaranteed.

Energy storage will be one of the the key technologies that can enable the transition to low-carbon energy production. Doing it through providing business value to the owners of solar projects throughout market-based operations of the plants might become the new standard.

At Green Dealflow, we aim to speed up installations worldwide, which need to increase from 17 GW in 2020 to 148 GW in 2025 in order to keep up with the IEA Net Zero Scenario.

Our focus is to provide our clients with fruitful business collaborations over their pipelines of projects, and energy storage is getting attention in the industry; we want to help with that.

Follow us for many more news and insights!

Green Dealflow is an exclusive matchmaker for professional investors and project developers in the solar and wind industry. For developers, we provide the service of introducing the relevant investors or PPA off-takers for their projects within 2-4 weeks (off-market with discretion). Other services we provide to the developers are secure data room service, financial modelling service, running a structured process to sell projects etc. For investors, we provide the project based on their investment criteria and run an RPF process to source projects in any market as a mandate holder. Further to this, we deliver renewable news and trends, blog posts and business intelligence, e.g. through transaction reviews etc., to our client base periodically. Remember to register your interest with us.