This year has severely impacted the human society, as we begin to recover a new wave is unleashing to transform societies. The UK has developed a ten-point plan in which the aim is to create millions of jobs, available through protecting our planet and future generations. Over the last 30 years, the UK has expanded their GDP by 75%, cutting 43% of their emissions, with low-carbon industries supporting 460,000 jobs. After the year 2019, in which the UK became the first major economy to adopt obligations to reach towards the zero-emission target by 2050.

The 2021 Ten-point plan is set to generate the foundation of another industrial revolution, colored in green. The government has in fact announced the support of green industries with incentives up until £5 Billion, mobilizing £12 billion on green jobs, probably impacting even more the private sector.

The goal is to put the UK at the core of the global markets for the energy revolution.

Not only, but the UK will not be able to set the stage for this action on its own and will strengthen its position as leader in green technologies by the Presidency of the Unitend Nations Framework Convention on Climate Change (UNFCC) Conference of the Parties 26 (COP26) in Glasgow, urging other countries to take action and deliver on the promises of the Paris Agreements in 2015.

1. Offshore wind

The UK is already a leader in offshore wind and plans to quadruple the capacity by 2030, investing in the infrastructure of ports and coastal regions, allowing for more jobs.

Not only, but the UK already generates most of its power through wind and the support of the Government has seen the cost of offshore wind, fall by two thirds in the last 5 years. The government aims at helping further the reduction of costs by doubling the number of renewables through the next contract for Difference auction.

By 2030, the production is set to reach 40GW of offshore wind, including 1GW of innovative floating offshore wind in the windiest parts of our seas, encouraging more than 20 millions of private investments in the UK.

To support the industry, the government will invest £160 million in the development of modern infrastructure together with the transformation of the energy system, building more network and investing in smart technology.

2. Low- Carbon Hydrogen

Together with the Industry, the UK is planning to develop 5GW of low-carbon hydrogen production capacity by 2030, making the UK benefit from around 8000 jobs across the industrial heartlands and beyond. The process will be supported through 240 million Net Zero Hydrogen Fund, allowing for new hydrogen business models, favoring private sector investments as well.

3. Delivery of Nuclear Power

The UK sees a key potential in the development of nuclear power, so the country is aiming at pursuing new projects with development funding. The UK is announcing £385 billion in Advanced Nuclear Fund, enabling investment of up to 215 million into Small Modular Reactors to develop a domestic smaller-scale power plant technology design, unlocking 300 million of private sector match-funding. With 170 million on R&D programs on Advanced Modular Reactor and additional 40 million to develop a matching regulatory framework, the UK aims at the cutting edge against international competitors.

4. Shift to zero-emission of vehicles

With cars and vans making up nearly a fifth of emissions, we are taking decisive action to end the sale of new petrol and diesel cars and vans by 2030, with all vehicles being required to have a significant zero emissions capability (for example plug-in and full hybrids) from 2030 and be 100% zero emissions from 2035. This will come alongside with a tax system that encourages the uptake of electric vehicles. The commitment is to have up to £1 billion to support the electrification of UK vehicles and their supply chains, including developing ‘Gigafactories’ in the UK to produce the batteries needed at scale. The Government will invest £1.3 billion to accelerate the roll out of charging infrastructure, targeting support on rapid charge points on motorways and major roads to dash any anxiety around long journeys, and installing more on-street charge points near homes and workplaces to make charging as easy as refuelling a petrol or diesel car.

5. Green Public Transport

The country will also invest in developing a suitable system of public transport to promote the transition to a sustainable way of moving. The investments target the railway network with tens billions of pounds, shared with buses, city public transport, cycling and walking. £120 million will be invested next year to begin the introduction of at least 4,000 more British built zero emission buses

6. Green ships and jet zero

British innovation will unlock the world of sustainable fuels, turning these fossil fuel intensive journeys into lower carbon routes of transportation that allow the opportunity of global travel whilst also safeguarding our planet. To achieve this, the establishment of the Jet Zero Council as a sector-wide partnership to accelerate the development and adoption of new technologies will help to develop a strategy to reach net zero aviation. The investments round up to £15 million into FlyZero – a 12-month study, delivered through the Aerospace Technology Institute (ATI), into the strategic, technical and commercial issues in designing and developing zero-emission aircraft that could enter service in 2030. The UK has a strong history in shipbuilding, with the maritime sector employing 185,000 people. To complement our work on aviation, we will invest £20 million into the Clean Maritime Demonstration Programme to develop clean maritime technology.

7. Greener Buildings

Actions of the reconfiguration of buildings will be at the heart of the economic recovery of the UK, supporting 50,000 of jobs, aiming at moving away from fossil fuel boilers over the next 15 years. Not only, but the opportunity will allow for the development of the growing UK heat pump manufacturing base and expand supply chains for building efficiency. Funding and regulatory measures, delivered in partnership with industry and stimulate near-term investments.

To stimulate investment and production, the aim is for 600,000 heat pump installations per year by 2028, creating a market led incentive framework to drive growth, and bring forward regulations to support this especially in off gas grid properties, leaving the open choice as whether we want to ultimately pursue hydrogen heating and an electrifying heating system.

8. CCUS

The new industry that the UK aims at developing will be capturing carbon and revitalize the spatial area affected by the first industrial revolution, through a program of Carbon capture, usage and storage (CCUS). 1 billion is estimated in the establishment of CCUS in four areas of the country: The North East, the Humber, North West, Scotland and Wales.

CCUS technology captures carbon dioxide from power generation, low carbon hydrogen production and industrial processes, storing it deep underground where it cannot enter the atmosphere. This technology will be globally necessary, but no one country has yet captured the market. The UK has an unrivalled asset – our North Sea, that can be used to store captured carbon under the seabed. Developing CCUSinfrastructure will contribute to the economic transformation of the UK’s industrial regions, enhancing the long-term competitiveness of UK industry in a global net zero economy. It will help decarbonise our most challenging sectors, provide low carbon power and a pathway to negative emissions

9. Natural Environment Protection

The protection of the natural environment will be ensured through the creation of new National Parks and Areas of Outstanding Natural Beauty (AONB). Starting from the designation of England’s beautiful and iconic landscapes as National Parks and AONBs, safeguarding these areas for future generations and bringing more people within closer reach of nature. These new National Landscapes will play a key role in meeting the government’s commitment to protect and improve 30% of UK land by 2030.

The creation of more green jobs is expected thanks to £40 million second round of the Green Recovery Challenge Fund. This fund will help create and retain thousands of jobs to work on nature conservation and restoration projects across England helping to improve biodiversity and tackle climate change.

10. Green Finance

The commitment of the UK to raise the total R&D investment to 2.4% of GDP by 2027 was already announced in July 2020 in the UK Research and Development Roadmap. Green innovation will help bring down the cost of the net zero transition, nurture the development of better products and new business models, and influence consumer behaviour. Alongside specific green polices, this will also be backed by an increase in public investment in research and development and the new agency designed to fund our scientists to pursue high reward work that will establish the change in the worlds path to net zero.

The launch the £1 billion Net Zero Innovation Portfolio will drive the intervention by setting the stage for the 10 main priorities.

- floating offshore wind

- nuclear advanced modular reactors

- energy storage and flexibility

- bioenergy

- hydrogen

- homes

- direct air capture and advanced CCUS

- industrial fuel switching

- disruptive technologies such as artificial intelligence for energy

The UK ha undoubtedly played a leading role in securing the agreement of 195 parties to sign up to the historic Paris Climate Agreement. Whilst progress has been made through the Paris Agreement, current commitments will not achieve the temperature goals that were set, instead implying a devastating rise of around 3°C of warming by 2100. Increased action at COP26 is therefore vital, and we will use our COP26 Presidency role to work through five priority areas – Adaptation and Resilience, Zero Emission Vehicles, Energy Transition, Nature, and Finance. This will match the internal shift the UK is bringing about, setting the stage for a greener future.

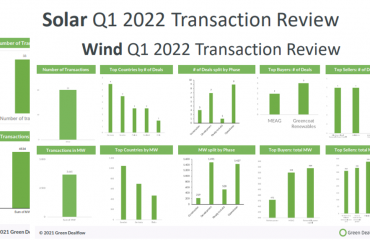

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports

If you want to read more on the energy plan of the UK and the future commitments, you can check the government website here