In May 2022 the Massachusetts Institute of Technology published the report “The Future of Energy Storage”, founded by The Alfred P. Sloan Foundation and The Heising-Simons Foundation.

Energy storage enables cost-effective deep decarbonization of electric power systems with high wind and solar penetration. Deep decarbonization will require massive investments in multiple energy storage technologies, as well as in transmission, clean generation, and demand flexibility.

This interdisciplinary study examines how electricity storage can play a critical role in cost-effectively balancing electricity supply and demand.

Here we introduce key takeaways of the MIT report.

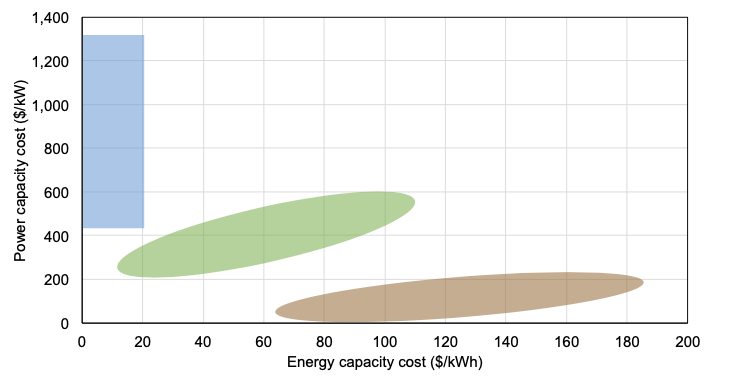

The report proposes the following storage technologies differentiation, based on the power capacity cost (the discharging and charging speeds), and the energy capacity cost (the energy volume stored in each storage plant).

Fig1. Three groups of storage technologies based on power- and energy-capacity costs

The blue region includes thermal, chemical (e.g., hydrogen), metal-air battery, and pumped hydro storage technologies. Flow batteries fall in the green area, while Lithium-ion batteries lie in the brown area.

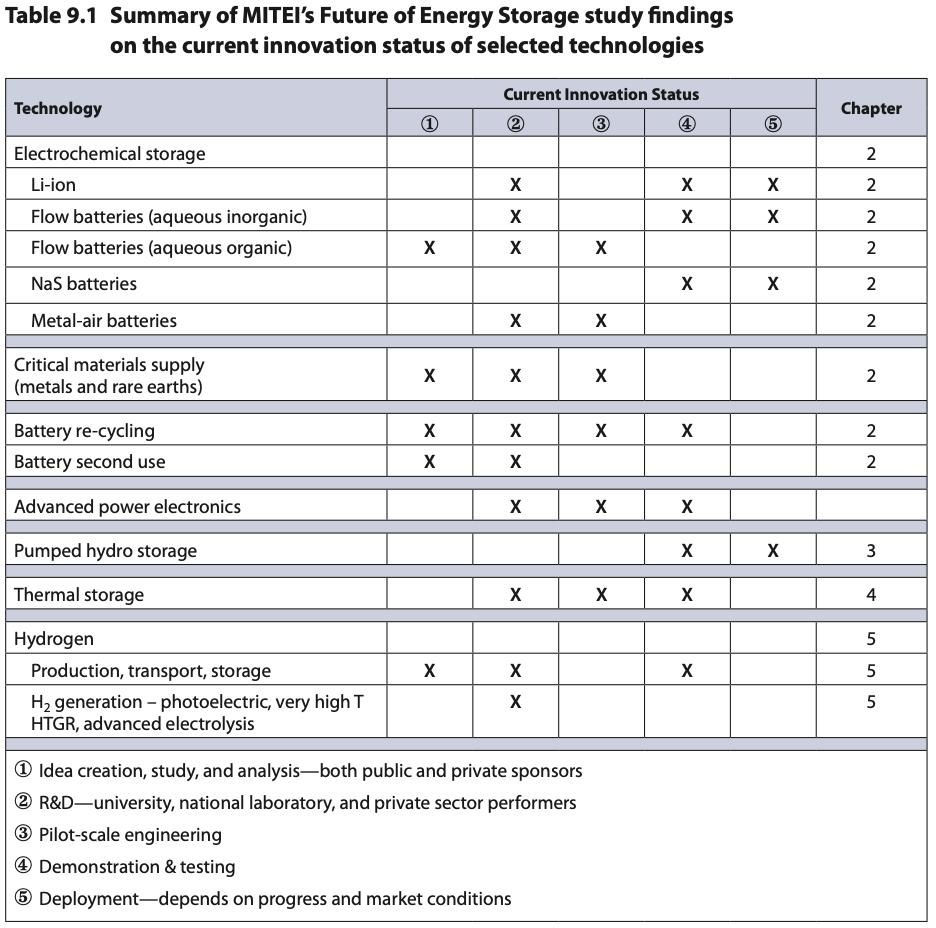

Among the types cited above, the table below addresses the current innovation status of various storage technologies, underlying those that are in an advanced stage of development, like lithium-ion batteries, and those which still lack deployment and commercialization or need to go through preliminary pilot projects after R&D developments before successfully go through the commercialization.

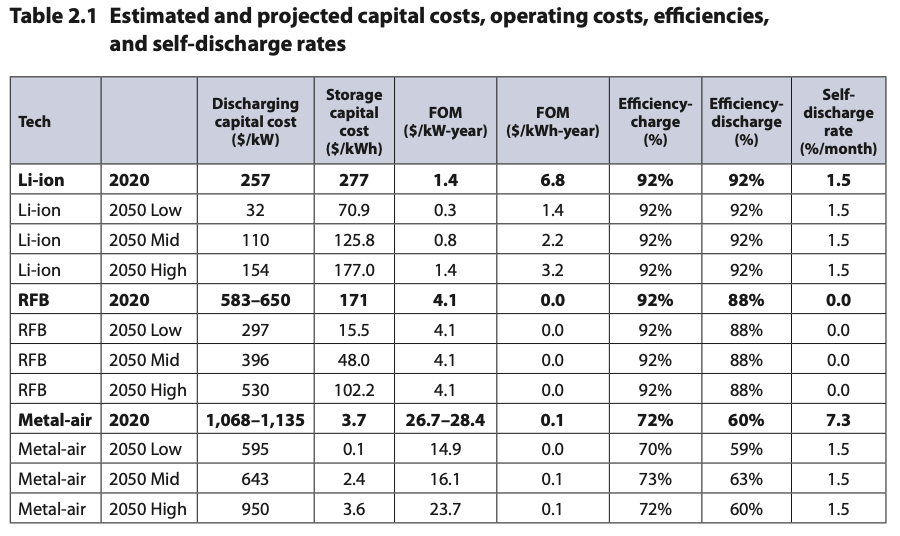

Having a look at the key performance indicators of the commercialized electrochemical storage technologies, the table below quantifies the current and forecasted values of the costs associated with estimated and projected capital costs, operating costs, efficiencies, fixed operations and maintenance (FOM), and self-discharge rates for lithium-ion (Li-ion) batteries, redox flow batteries (RFBs), and metal-air batteries together with projected scenarios of the same values for 2050.

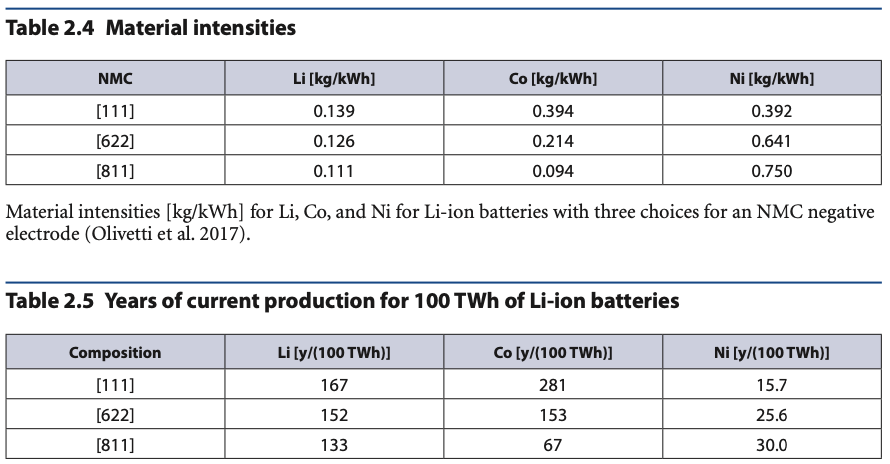

Given these numbers, an interesting question answered by the report is: “How much time would it take to deploy lithium, cobalt, nickel, or vanadium electrochemical storage at the TWh scale? (100 TWh)”

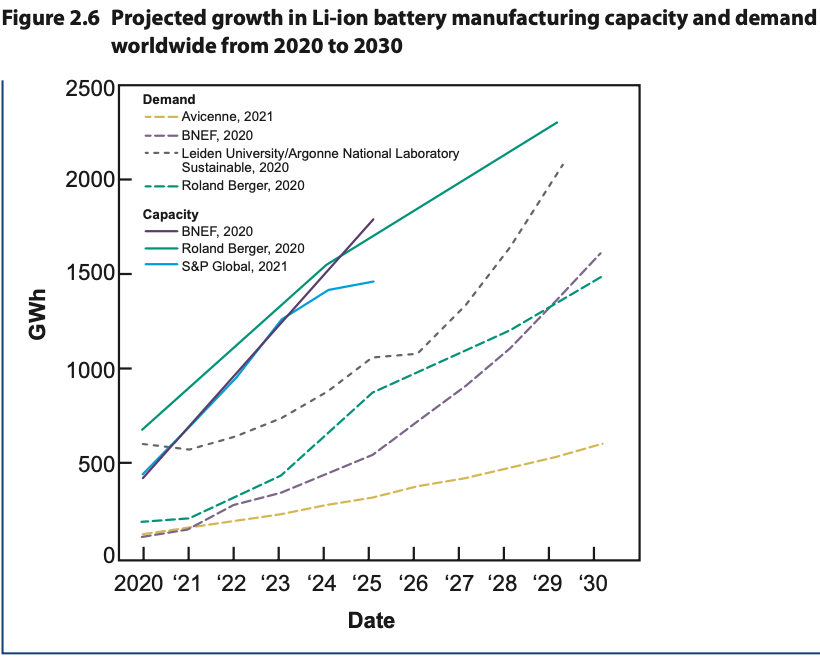

The traditional approach to answering this question is to compute the time at current rates of production, however, this approach doesn´t consider the relatively low present demand of material compared to the future one, with the possibility to ramp up considerably in response to this. In regards to demand, the figure below also points out that, according to the current estimates, in the next 5-10 years the lithium-ion battery manufacturing capacity will keep up with global demand.

According to the current forecast and given its performance, the lithium-ion battery is expected to take a central role in the future of energy storage, with other technologies filling the gap between high renewable-based grids and a net-zero emission framework.

To have a clear picture of the whole spectrum of technologies and more insights on the future of energy storage see the full study here.

Green Dealflow is an exclusive matchmaker for professional investors and project developers in the solar and wind industry. For developers, we provide the service of introducing the relevant investors or PPA off-takers for their projects within 2-4 weeks (off-market with discretion). Other services we provide to the developers are secure data room service, financial modelling service, running a structured process to sell projects etc. For investors, we provide the project based on their investment criteria and run an RPF process to source projects in any market as a mandate holder. Further to this, we deliver renewable news and trends, blog posts and business intelligence, e.g. through transaction reviews etc., to our client base periodically. Remember to register your interest with us.