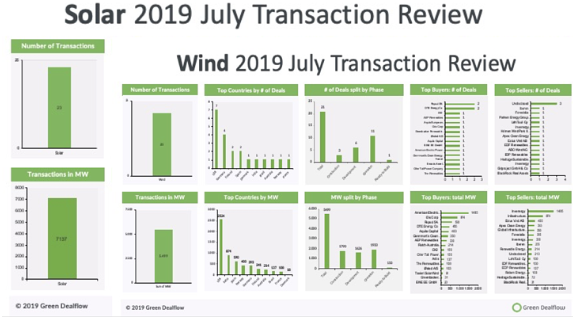

This week, Green Dealflow published its monthly transaction activity report of the solar and wind industries for July (access it here). The report is built from Green Dealflow’s transaction database that tracks equity transactions of solar and wind projects around the globe. Altogether the month of July has been busy as compared to June both in terms of the number of transactions and total capacity transacted in solar and wind transactions. We captured 44 solar and wind deals overall mounting to 12.6GW (gigawatts).

In the solar industry, the report records a total of 23 transactions amounting to more than 7.1 GW in gross capacity transacted. As compared to a quiet June with only 17 transactions amounting to 1.5GW, July was rather busy regarding the number of transactions, and especially MW transacted in solar energy deal flow.

Different than last month, Spain was in the leading place regarding total MW transacted with transactions amounting to 3447MW. The leading position of Spain was due to Brookfield Renewable Partners’ transaction. The renewables arm of Canada’s Brookfield Asset Management announced the acquisition of the 50% stake of the Spanish solar developer and operator X-Elio.

Brazil followed Spain with a single transaction of UK-based Lightsource BP, that acquired 1900MW of greenfield solar projects in Brazil from the Brazilian developer Enerlife.

In the wind industry, the report records a total of 21 transactions amounting to 5.5GW in gross capacity transacted. As compared to a quieter month of June with 3.6 GW in 18 transactions, July was 25% more active regarding MW transacted in wind energy deal flow.

USA was in the leading place regarding total MW transacted with transactions amounting to 2.5GW. The leading position of the USA was due to American Electric Power Company acquiring three under-construction wind farms in Oklahoma with a total sum of 1485MW.

India was in second place with one transaction of 784MW, in which IL&FS received the approval to sell the 51% stake of seven operating farms portfolio to the financial services conglomerate Orix Corp.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.