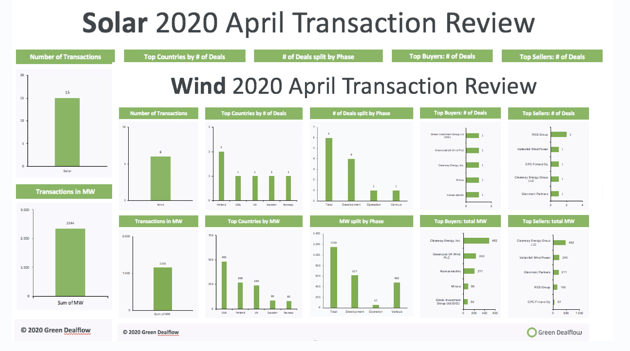

Out now Green Dealflow´s solar and wind transaction activity report in the solar and wind industries for April (access it here). The Green Dealflow Report is built on our transaction database, which tracks equity transactions of solar and wind projects from around the world. The world has been slowing down this past month due to the COVID-19 crisis and the renewables world expected a decrease in transactions. Nonetheless, the number of transactions in April shows a solid, trustworthy and long-term fruitful market even in these months of uncertainty.

With 21 transactions recorded in wind and solar industry, we reach up to an overall capacity of 3.5 GW. With respect to the month of March, which counted 7.65 GW of capacity transacted, the results show a decreasing trend, similar to the one registered in February. This negative trend is a character that both wind and solar industries have in common, which is more evident for the wind industry this month.

Even though we registered an overall lower gross capacity transacted with respect to the last month, the solar industry records a total of 15 deals (16 in March), reaching up to 2.4 GW in gross capacity. Since the past 3 months, the U.S. is maintaining the first step of the podium, but Vietnam is surpassing the Americans in April by collecting 750 MW transacted. Among the several news worth mentioning, the top buyer this month is Super Energy Corp. The Thailand-based energy corporation will have the majority stakes in four different PV assets in construction phase in the Southern region in Vietnam. The projects are scheduled for completion by the end of 2020. From one to the other side of the world: in the spotlight this month, the Little Bear Solar Complex in California owned by Longroad Energy has finally secured the funds to start building the solar complex. This was possible with the 50% acquisition by two different Danish Pension funds.

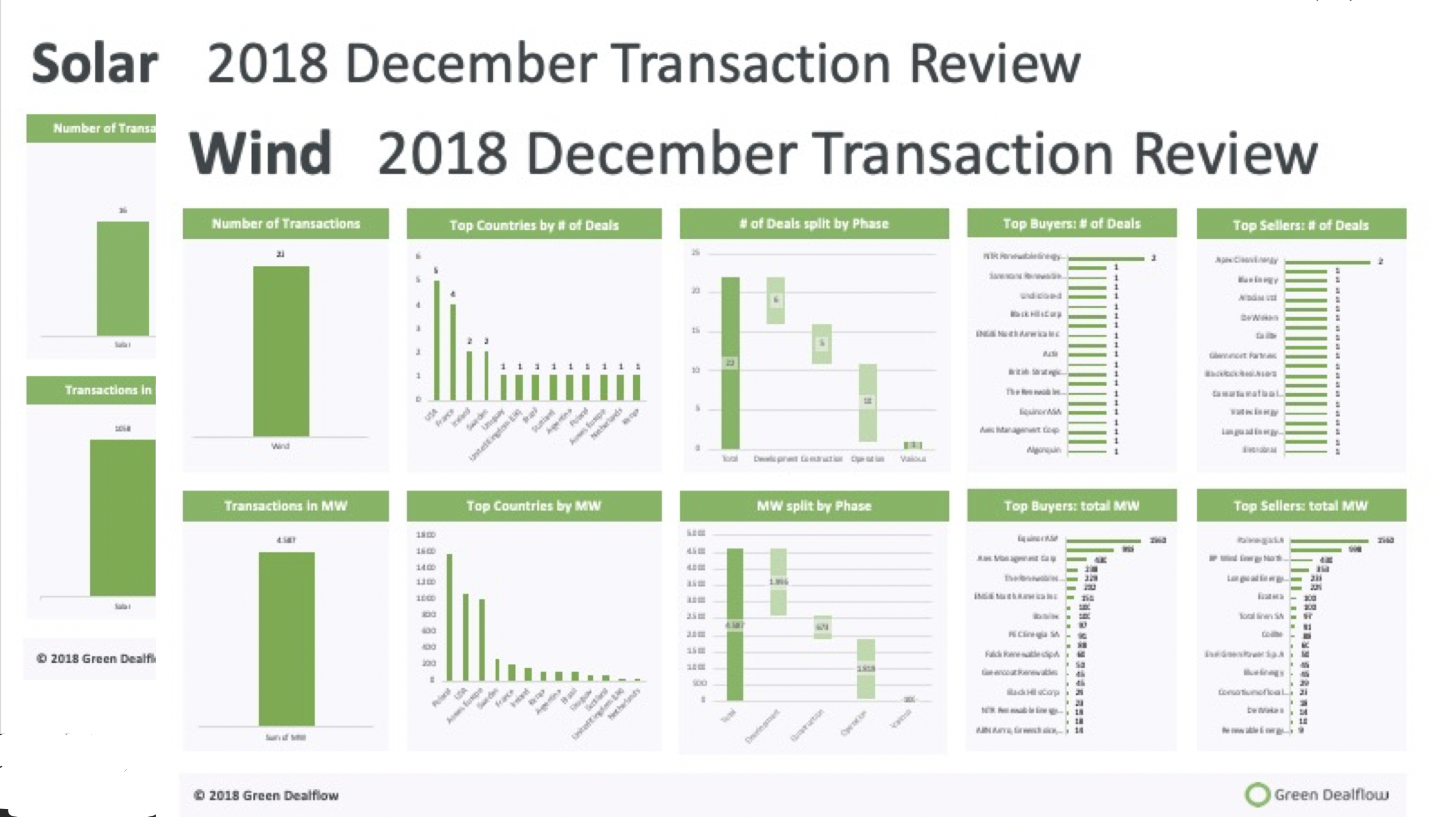

The numbers are different when It comes to the wind industry: with 6 deals closed, around 1.15GW in gross capacity was transacted. By looking at the past trends, we see a clear decrease in the total number of transactions. Nonetheless, among the several transactions recorded, the interest revolves around the 80% stake, that a Swiss equity private fund has acquired in the German Renewables developer VSB. The German company is active in 8 countries, managing wind inshore and offshore projects. The Private Fund motivates the investment by highlighting the importance of sustaining the renewables market as high priority issue in the economic, political and social agenda. Given the recent developments in the market and the increasing interest for green energy investments, we look forward to the next months of transactions.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.

Visit us at www.greendealflow.com.