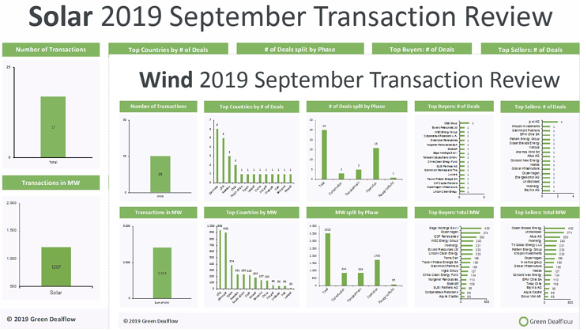

This week, Green Dealflow published its monthly transaction activity report of the solar and wind industries for September (access it here). The report is built from Green Dealflow’s transaction database that tracks equity transactions of solar and wind projects around the globe. Altogether the month of September has kept the pace of August both in terms of the number of transactions and total capacity transacted in solar and wind transactions. We captured 42 solar and wind deals overall mounting to 4.7GW (gigawatts).

In the solar industry, the report records a total of 17 transactions amounting to more than 1.2GW in gross capacity transacted. As compared to a similar August with 16 transactions amounting to more than 1.5GW, September continued to be a rather quiet month regarding both the number of transactions, and MW transacted in solar energy deal flow.

Equally to last month, the US was in the leading place regarding total MW transacted with transactions amounting to 870MW. The leading position of the US was mainly due to a series of transactions with Duke Energy, Recurrent Energy and Copenhagen Infrastructure Partners as the major sellers, and John Hancock Infrastructure and Ingka Group as the top buyers. Chile followed the US mainly due to the acquisition by Empresas Gasco of Copiapo Energia Solar, the developer of a 150MW project in the region of Atacama.

In the wind industry, the report records a total of 25 transactions amounting to 3.5GW in gross capacity transacted. As compared to a slightly more modest month of August with 3.2 GW in 26 transactions, September did not represent a change in activity and remained way below from the most active month of this year.

The US was again in the leading place regarding total MW transacted with transactions amounting to 938MW. Among the more significant transactions, it is the acquisition of the 80% ownership of the Thunderhead Wind Energy Center in Nebraska. A project of 300MW developed by Invenergy. Germany was in second place due to the purchase of Ocean Breeze Energy by Sage Holdings. The transaction concerned Bard Offshore 1, an operational asset of 400MW now with a new owner indirectly controlled by Macquarie Group Limited.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.