This is the time of the month , when Green Dealflow publishes its transaction activity report in the solar and wind industries for September that you can access here. The report is built on our transaction database, which tracks equity transactions of solar and wind projects from around the world and it available for you to have an insights of where the market is going.

September is known for being a slower month with respect to the others, most of the businesses start again after the summer, some others prefer to have holidays in this month! This tendency might be replicated into our market, and the reason is that the renewable energy industries of solar and wind are performing a little bit less intensively than last month in terms of deals signed. On the other hand, the capacity transacted is higher: our analysts tracked 35 transactions, against the 43 of last month. The capacity transacted reaches up to 11 GW in both industries, 1 GW more than the past month, increasing after the spring numbers. Green energy and the transition into a renewable energy powered society is here and now.

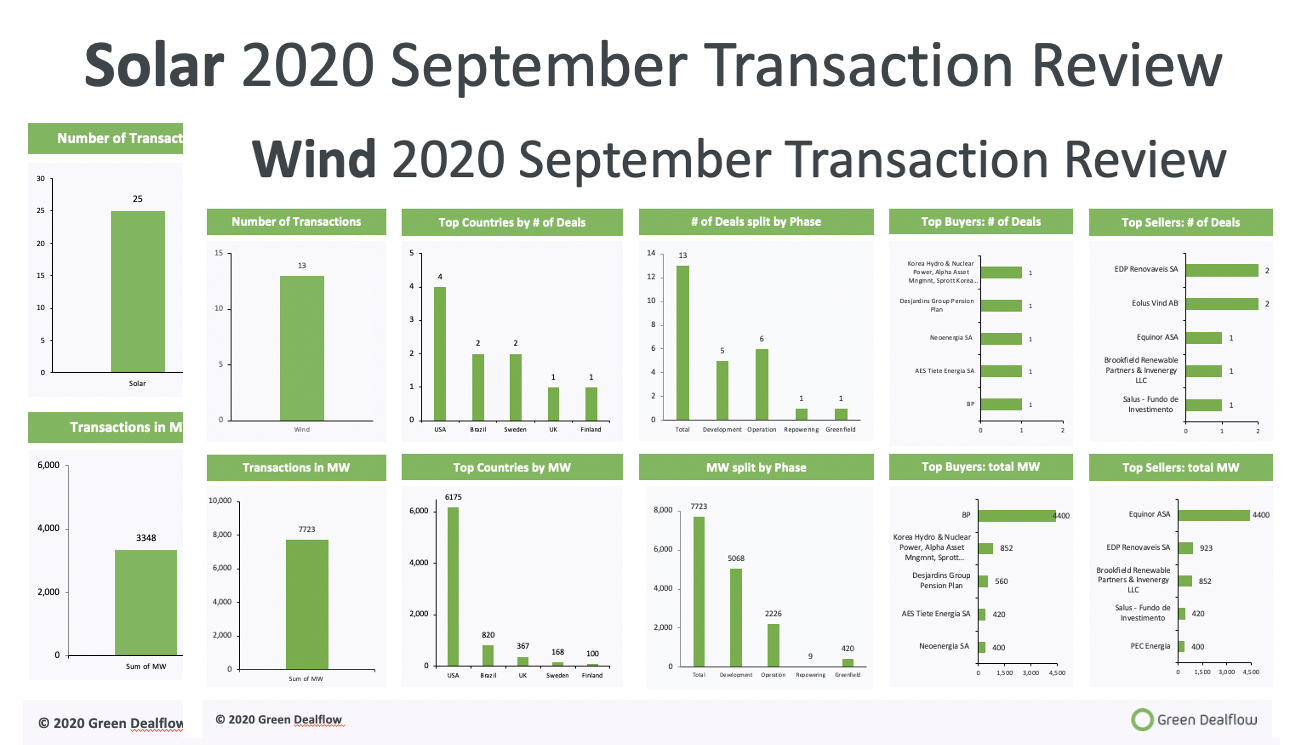

The solar industry´s performance this month is impressive with respect to the past 3 months, getting a total of 25 deals, with an overall capacity of 3.3GW. Among the most active countries this month, the U.S. remains our top country, but this time hitting the ceiling with 9 transactions. This month the presence of some European countries warms our hearts: Poland, Spain and UK are doing very well in the market, especially Poland is a state to keep our eyes on. India entered our transaction database last month and is already chasing the first position of the U.S..

Among the several transactions, Kruger Energy, a business unit of Kruger Inc., has sold a 523MW mid-stage solar development portfolio to Ecoplexus, a leading renewables IPP. The development portfolio will provide clean energy to hundreds of thousands of households in the states of Georgia and Tennessee. The portfolio is well-positioned in the Southeast.

In the wind industry, the 7.7 GW transacted are showing a slight increase in comparison with the numbers of August and July. The deals signed were 13, little less than in August and with an increasing interest around the developments of offshore wind, which have the potential to power most of our cities. In the top 5 countries, the U.S. is leading the way, followed by the Brazil, Spain, UK, Finland. Among the transaction, 4.4. GW have been transacted by Equinor: the signing of an agreement with BP to sell 50% non-operated interests in the Empire Wind and Beacon Wind assets offshore on the US east coast for a total consideration before adjustments of USD 1.1 billion. Empire Wind is located 15-30 miles southeast of Long Island and spans 80,000 acres, with water depths of between 65 and 131 feet with a potential total installed capacity of more than 2 GW. Power generation from each site will be sufficient to power more than 1 million homes

This month was full of interesting projects and deals signed, all in the perspective of keeping the green wave crash into the market. Stay updated with our website and looking forward for the next month!

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.