This is the time of the month, when Green Dealflow publishes its transaction activity report in the solar and wind industries for November that you can access here. The report is built on our transaction database, which tracks equity transactions of solar and wind projects from around the world and it available for you to have an insight on where the market is going.

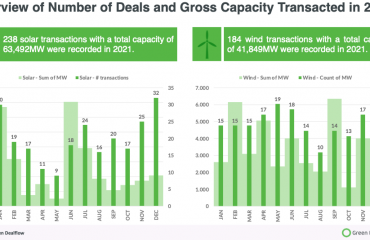

November has been a month that has some similarities with the trend of October. Renewables have been in the spotlight, with several international organisations and Governments, increasing investments and reviewing policies to ease the transition of clean energy. What we see as analysis’s, is an overall increase in the attention of markets towards green investments, co-development options and realisation of projects, that is spread all around the globe. This trend has reached a stabilisation this month, with the number of transactions for the overall market for a total of 39 transactions tracked, amounting at 6.7 GW, a small decrease is the capacity, but not on the absolute numbers. For us, this means that there is a widespread feeling among the population, that small local communities are also turning green. This is what we like about green energy: it is democratic and everyone of us can decide to engage in change!

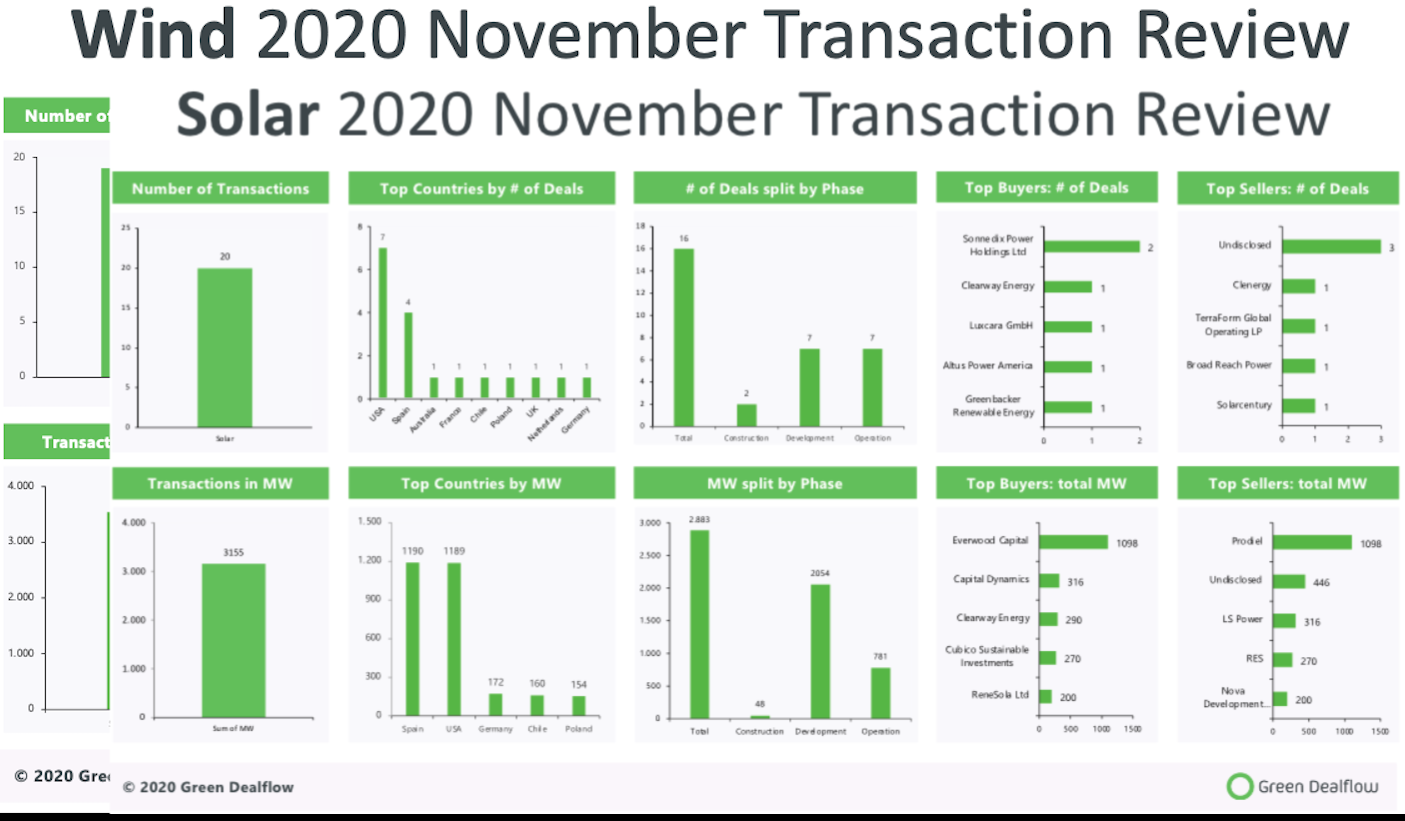

The solar industry performance this month is aligned with our expectations, getting a total of 20 deals, with an overall capacity of 3.2GW, a bit less with respect to the last month. Among the most active countries, the U.S. remains our top country, leading the way with 7 transactions. The Green Deal signed by the EU Union is giving its fruits, as we see among the top countries 6 EU countries closing solar energy projects. This means, that the regulatory frameworks inside of the countries are easing the way to the green transition . Good job!

Among the several transactions, ReneSola has wrapped up on a purchase of 200MW of US solar. The transaction gives ReneSola access to utility projects and development activities in several states, including Pennsylvania, California, New York, Maine, Illinois and Arizona.The new projects bring expertise in the development of distributed generation and solar plus battery in the US which will complement ReneSola’s existing focus on community solar in the US and distributed generation in Europe.

In the wind industry, the 3.5 GW transacted for 19 deals signed, suggest a stable trend in the activities of this month. In the top 5 countries, the U.S. has slide towards the last position, while Germany is in the pole position with 5 deals signed, followed by France, UK and, as mentioned above, the US.

A story coming this month from Germany, is the German renewables developer Energiekontor AG (ETR:EKT), which sold the 7.3-MW wind farm in North Rhine-Westphalia state to compatriot Commerz Real AG. Commerz Real, is a part of the German banking group Commerzbank AG, which has recently launched an investment fund on renewable energy projects in Germany,. The power plant’s output of around 18.7 million kWh of electricity per year is enough to cover the consumption of nearly 4,600 German homes.

This highlights how much the green energy transition is a matter that is leading the way in the policy frameworks of countries, internationally and also in private banking. This month was full of interesting projects and deals signed, all in the perspective of keeping the green wave crash into the market. Stay updated with our website and looking forward for the next month!

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.