Here you can see the annual solar and wind transaction report from Green Dealflow for 2021.

This report´s data comes from Green Dealflow´s solar and wind Transaction Database, which is filled with all the transactions publicly announced during the year around the globe.

This report contains six sections:

- Overview of global deals and gross capacity transacted,

- Comparative data between 2020 and 2021,

- Top 20 countries by number of deals,

- Top 25 sellers by number of deals and MW transacted,

- Top 25 buyers by number of deals and MW transacted,

- The lifecycle stage of MW transacted each month.

This article aims to describe and provide insights regarding the data within each of the sections, underlying recent developments and market trends that happened in 2022.

You can get access to the report here.

Solar Industry

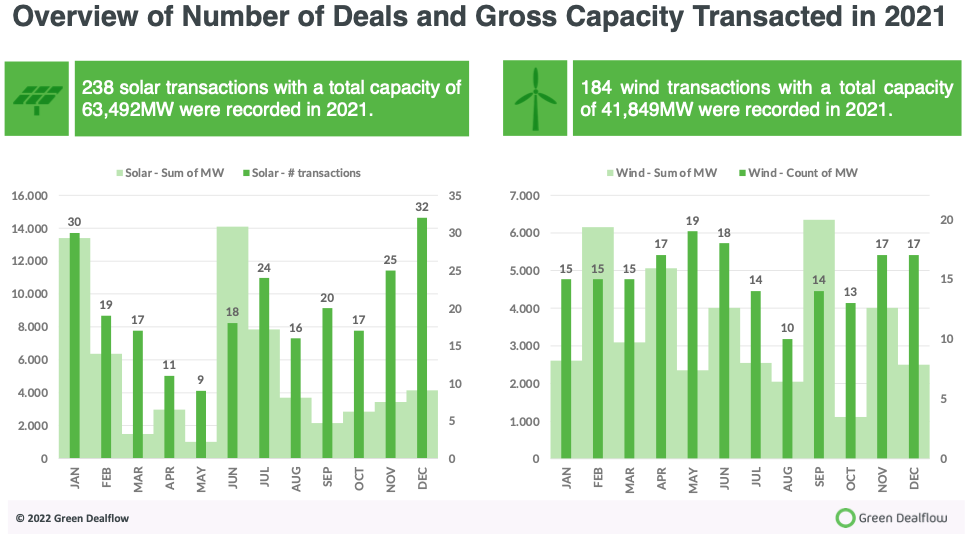

In 2021 a total of 238 transactions in solar projects have been recorded, a small decrease is observed compared to the previous year. From the gross capacity perspective, there has been an increase of 25% compared to 2020, with 63.49 GW in 2021. Comparing the values of 2021 with 2019 it is possible to observe a broader view of the transacted capacity trend, increasing by 57% in the two years period.

The months with the highest transactions recorded have been January, November, and December, with more than 24 deals in each. January, June, and July have been the busiest when looking at gross capacity transacted; May has been the most inactive one.

The US continues to be at the top of the ranking regarding the number of deals and gross capacity in the solar industry with 58 transactions, followed by Spain and Italy.

The solar projects top-sellers in 2021 have been Etrion Corp, BayWa r.e., Statkraft AS, and ReneSola Ltd with 4 transactions; at the same time the when looking at the gross capacity transacted First Solar leads the ranking a total of 13 GW.

On the other hand, regarding the top buyers, Sonnedix Power Holdings Ltd has been found to have closed the highest number of deals, while LightSource BP has purchased most of the solar capacity.

Most of the projects were classified in the Operational and Development stages.

Wind Industry

Similarly, a total of 184 transactions in wind projects have been recorded in 2021, a decrease compared to 2020. The gross capacity saw a decrease of 10% compared to 2020, with 41.84 GW in 2021. Comparing the values of 2021 with 2019 a 39% decrease is observed in the total capacity transacted, confirming the declining trend in the wind industry transacted capacity.

In 2021 the months with the highest transactions recorded have been May and June, while August has been the most inactive one for wind projects.

The US leads also in the wind industry with 33 deals and almost 35 GW of gross capacity, followed by Sweden and Germany for the number of transactions, and the Netherlands and Ireland for capacity transacted.

The wind project top-sellers in 2021 have been EDF Renouvelables and Vattenfall AB with 6 deals. At the same time the when looking at the gross capacity transacted Vattenfall AB and Ørsted A/S lead the ranking with more than 2.5 GW each.

Encavis Asset Management AG closed instead the highest number of deals, while Iberdrola purchased most of the solar capacity.

Also in this case the majority of the projects were classified in the Operations and Development stages.

Follow us for more market data and insights!

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.