Green Dealflow has published its transaction activity report in the solar and wind industries for July, that you can access here. The Report is built on our transaction database, which tracks equity transactions of solar and wind projects from around the world.

We were expecting an increase of transactions by looking at the past trends of this year. Not only, but new projects with innovative technology have been set up, and everything seems to run in the direction we hoped for: the green wave is hitting and we are ready to surf it. The renewable energy framework of every country are being revised to facilitate developers and investments, with the aim to slowly start building a green brand for our society.

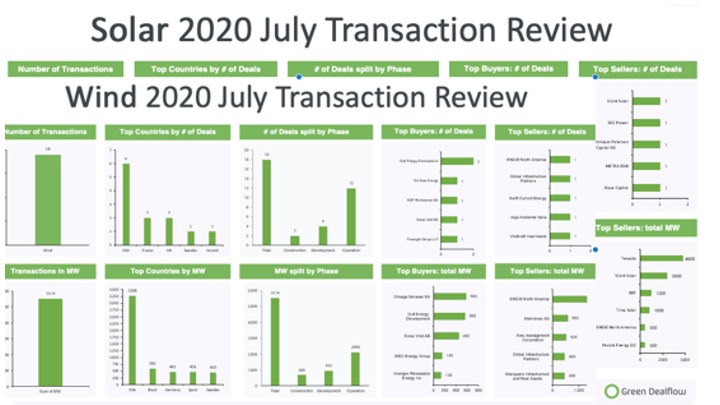

The renewable energy industries of solar and wind are in fact showing a skyrocketing trend, probably due to the political momentum around renewables. In total, 45 were the transactions registered by our team, doubling the 23 transactions of June. Same trend goes for the capacity transacted: close to 5 times the capacity of June (4,5 GW), July gives us a glorious 18,5 GW. We were missing those numbers and we want to see more in the next month, as it seems to us, the green energy market does never stop and does not even go on holiday! But what happened in the specific industries?

The solar industry´s performance this month is increasing with respect to the past 3 months, getting a total of 26 deals, with an overall capacity of 9,6GW. The solar market is now pushing through, especially thanks to the large democratization of this technology. Among the most active countries this month, the U.S. remains our top country, but this time hitting the ceiling with 11 transactions. The big surprise is the presence of several other countries, with increasing number of deals signed: the market was really dense, and we see Spain, UK, France, Australia, Brazil, Portugal and the Netherlands successfully having hands on the market. The massive number of MW transacted this month, belongs for a big share to the successful agreement signed between Capital Dynamics and Tenaska. The transaction comprises 24 solar projects located in the Midcontinent Independent System Operator (MISO) and Southeast Reliability Council (SERC) markets, totaling 4,800 megawatts (MW). This strategic partnership will increase substantially the greenfield solar footprint in both the Midwest and South-East of the U.S.

In the wind industry, the 5.6 GW transacted are showing a slight increase in comparison with the numbers of June. The deals signed were 19. the solar industry ones with only 11 deals signed: the The three main actors are the U.S. at the top, followed by France and UK. Sweden and Ireland are following, but there are high expectations for those two countries to become main actors, at least in the European Market. Of interest, Gulf Energy Development acquired 50% of a wind farm located in the German North Sea, the BKR2 offshore wind farm project , with an installed capacity of 464.8MW. The project entered into commerical operation last April. Danish renewable energy company Ørsted holds the remaining 50% stake. Gulf Energy Development said the acquisition is in line with its strategy to increase its renewable energy business in the overseas markets.

Beside the current deals signed, the offshore wind industry has been developing, innovating with a higher pace than the other energies: several are the positive aspects of offshore, and more and more research is been done to set up a new standard for renewables, in order to exploit the oceans and sea. We will keep you updated on the developments in the market

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.