This is the time of the month when Green Dealflow publishes its transaction activity report in the solar and wind industries for December, available here. The report is on our transaction database, which tracks equity transactions of solar and wind projects from around the world and it is possible for you to have an insight into where the market is going.

December 2020, the last month of a year that turned our lives upside down and changed our perspective. What we observed in the last month with respect to November is a stable trend in transactions, meaning that the renewable energy market has been suffering from the crisis, but the overall attitude of governments and investors, sees in renewables a key element for re-growth after such a complex year. The world has shifted its purpose, focusing more on sustainability, green economy and energy transition.

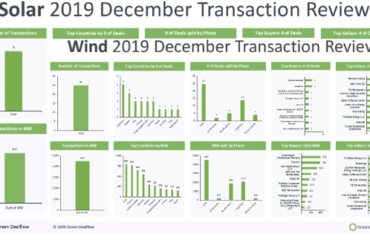

The number of transactions for the overall market counts for a total of 54 transactions, amounting to 7 GW, an increase in absolute numbers, but a small difference from the capacity transacted in November. For us as analysist, this means that there is a growing good feeling in investing in renewable projects with even small capacity, but that contributes heavily to the transition of the overall society.

The solar industry performance this month is aligned with our expectations, getting a total of 34 deals, with an overall capacity of 3.4GW, a bit of an increase with respect to the last month. Among the most active countries, the U.S. remains our top country, leading the way with 10 transactions. The new entries this month are Japan, 4 transactions counted, Australia and Spain too in our top 5.

Among the most relevant transactions, we want to focus on the 1GW that the Independent power producer sPower has announced. The acquisition of solar power projects in New York from National Grid Renewables is highlighting the strategic acquisitions and partnerships created to fulfill the renewable energy development strategy of the US.

In the wind industry, the 3.1 GW transacted for 20 deals signed, suggests a stable trend in the activities of this month. In the top 5 countries, the U.S. takes up the podium, with following Brazil, the UK and Finland, each gaining their position in the TOP 5 with 2 transactions.

Among the several deals signed, Eni has entered into an agreement with Equinor to purchase a 10% interest in Dogger Bank A and B from project partner SSE. This is the third transaction for Equinor, but the first one of ENI entering the offshore wind market in Northern Europe, contributing to the 5GW goal by 2050, set by the European Union. The transaction is expected to be finalized in 2021, but it´s a great intermediate step that we want to put emphasis on, collaboration among the big companies in our continent for a shared purpose!

Green energy transition is a matter at the core of policy in every government, not only, but many more private companies see the benefits of investing in such long-term profitable and goal-oriented projects, aiming at making the world better. What do we expect for next year? Surely, we aim to see even more transactions and policy frameworks that facilitate green investments.

Stay updated and follow us for many more new insights!

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports