What is ISEM?

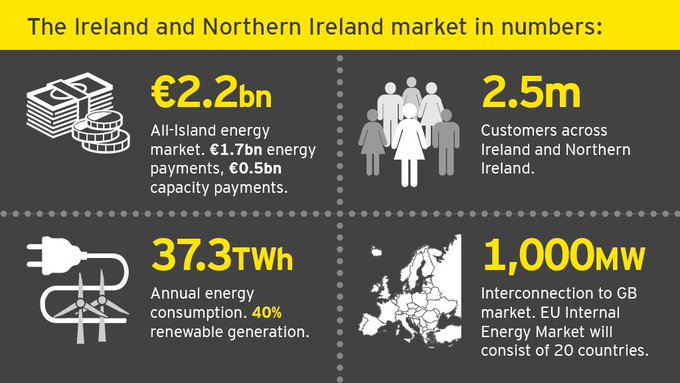

The Wholesale Electricity Market on the island of Ireland is undergoing significant change to integrate with European markets and to align with 2030 policy objectives to achieve 70% renewable generation in the electricity sector. With The Integrated Single Electricity Market (ISEM), which was introduced on October 1st, 2018, changes to the way energy is traded as the market here aligns with European rules has already taken place. For utility companies and large energy-consuming businesses these market forces bring new challenges and opportunities. In this article, I will break down the components of the market and the opportunities across the island.

Table of Contents

Major market reform

This included more trading windows with Day Ahead, intra-day and short-term energy balancing trading periods. Auctions for capacity contracts were also introduced with the overall market allocation for capacity revenues decreasing from €530m to €330m. Coupled with this was the launch of the €235m System Services market under EirGrid’s Delivering a Secure Sustainable Electricity System (DS3) program. This market is designed to facilitate more renewable generation by incentivizing services that help keep the grid stable at critical times.

Utilities operating or looking to enter the Irish market need to continually refine methods of sourcing of revenue across the ISEM and DS3 System Services frameworks. This means ensuring that the trading capability supports systems and processes that function in the new market over a sustainable period and that the utility is agile enough to handle the changing landscape of the market as it transitions to a decarbonized future. The following are key aspects of the wholesale electricity market under the ISEM rules.

Capacity winners and losers

The Capacity Auctions result in some generators receiving contracts for reliability whilst others will not receive these payments. This will have a significant impact on the revenue streams and market strategies of generators. Already, older generating units have exited the market and even those generators that have been successful in the auctions have faced downward pressure on payments for capacity. With government policy focusing on decarbonization, it is expected that the capacity market will result in older carbon-intensive plants exiting whilst opportunities will exist for lower carbon technologies.

Increased trading activity

With the new day ahead and intra-day market windows, there has been an increased emphasis on trading activities for generators and suppliers. Price volatility has been observed at certain times and strategies will need to be developed to effectively adopt positions in these new market windows as more renewables connect to the Irish grid.

Balancing responsibilities

The ISEM arrangements require all market participants to be responsible for delivering or consuming the amounts of energy that they have submitted to the market. Generators, wind farms, and suppliers must all manage the exposure to volatile prices for imbalances in their energy in the market. Forecasting of energy supply or demand is key for generators and suppliers to capture the most value from these new markets and avoid exposure to volatile prices.

Opportunity for new value-added services

There are 14 value-added system services that participants can tender for through the DS3 System Services framework. These services include traditional reserve products, such as Primary and Secondary Operating Reserves, and new fast-acting services to help support grid stability. Most market participants will have the capability to provide a subset of the 14 services and can assess them based on the capabilities of their generation asset. As the market develops, more opportunities to provide services will emerge and new service offerings may be defined to support the stable operation of the grid.

Openings for new technologies

New technologies will play a significant role in the transition to a power system with high penetrations of renewable generation. Arrangements have been developed for the treatment of storage devices and demand response in future capacity auctions. The opening up of capacity and DS3 System Services provides significant opportunities for utilities to make investments in new technologies. There are also now attractive signals for large energy users to harness the flexibility within their own consumption to provide services and generate revenues to offset energy costs.

All of this means that utilities face changes to traditional operating models. The need for these businesses to plan for and respond to the current and future requirements of I-SEM presents significant resource demands. As in any market, some participants will face challenges, yet there clearly are opportunities to be successful.

Putting the pieces together for DS3 and I-SEM:

Clear market strategy

Creating trading strategies that optimize returns across the different markets will be essential. One such area that participants will need to consider is making trade-offs in trading in the Ex-Ante or balancing markets versus being available to provide services. Effectively assessing the opportunity cost in these situations will form part of the overall trading strategy.

Optimizing performance and reliability

In a market with an increasing focus on price and asset performance, having appropriate control over costs is critical. A key element of the DS3 System Services framework is to incentivize best-in-class delivery and reliability in performance. To ensure maximum revenues, generators will need to ensure that their asset can deliver the highest level of service possible, on a consistent basis. Monitoring performance, minimizing outage times, and ensuring reliable delivery will be critical to success.

New opportunities

New technologies could threaten revenues from traditional assets. An effective strategy to seize the new opportunity whilst also managing threats to existing operating models will be key. The auctions for new technologies will attract interest in the short term but it will be important to consider all revenue streams from DS3, Capacity, and the energy markets when making investment decisions and market entry strategies over the medium to longer term.

Customer data and agility

In the future green-focused world, the customer will become a much more active participant in the transition. The lessons from other energy markets indicate that analytics to identify customer value will be increasingly important. Successful suppliers will be able to extract value from consumption data to reduce risks in short-term markets. Collaborating with larger customers to understand short-term electricity demand variations can reduce costs and offer value. This requires agility and new ways of working across operations, customer service, and billing.

Risk and reward for large consumers

The new arrangements under ISEM and DS3 create opportunities for large energy users on the island. For industrial customers, capacity charges will decrease as new auctions lead to reduced prices. DS3 also offers a route for customers to harness flexible consumption to provide services and generate revenues to offset energy costs. Engaging with your supplier and with a demand aggregator can provide a route for large energy users to best use their assets and reduce overall costs.

ISEM and the DS3 System Services framework have led to a transformation in the wholesale energy markets on the island of Ireland. As the transition to a decarbonized future continues, utilities must redefine their approach to engaging in the market. Those who fit the pieces together to form a coherent strategy will stand to benefit the most. Utilities will need to be open to adopting new and flexible approaches and place this at the center of their trading strategies to continue to navigate the transformation of the sector.