This week, Green Dealflow published its solar and wind monthly transaction review for May (access it here). The report is built from Green Dealflow’s transaction database that tracks equity transactions of solar and wind projects around the globe. Altogether the month of May has been a busy month with regards to the number of transactions in both solar and wind but slow in terms of total capacity transacted. We captured 42 solar and wind deals overall mounting to 7.644GW (gigawatts).

In the solar industry, the report records 22 transactions amounting to more than 4.38GW in gross capacity transacted. As compared to a busier April with 24 transactions of more than 5.5GW, May was slightly slower regarding MW transacted in solar energy deal flows. Different than last month, France were in the leading place regarding total MW transacted with one transaction of than 1.35GW.

Swiss energy trader Axpo has boosted its PV footprint through the purchase of France’s Urbasolar. The acquisition lands the buyer with a 350MW portfolio of built and under construction solar plants, as well as an additional 1GW at advanced development stages.

China followed France with transactions amounting to around 977MW: GCL-Poly Energy Holdings Ltd and its majority-owned unit GCL New Energy Holdings Ltd, or GNE, agreed to sell controlling stakes in 19 Chinese solar power plants. The full capacity in comparison to the previous month went down by around 20%.

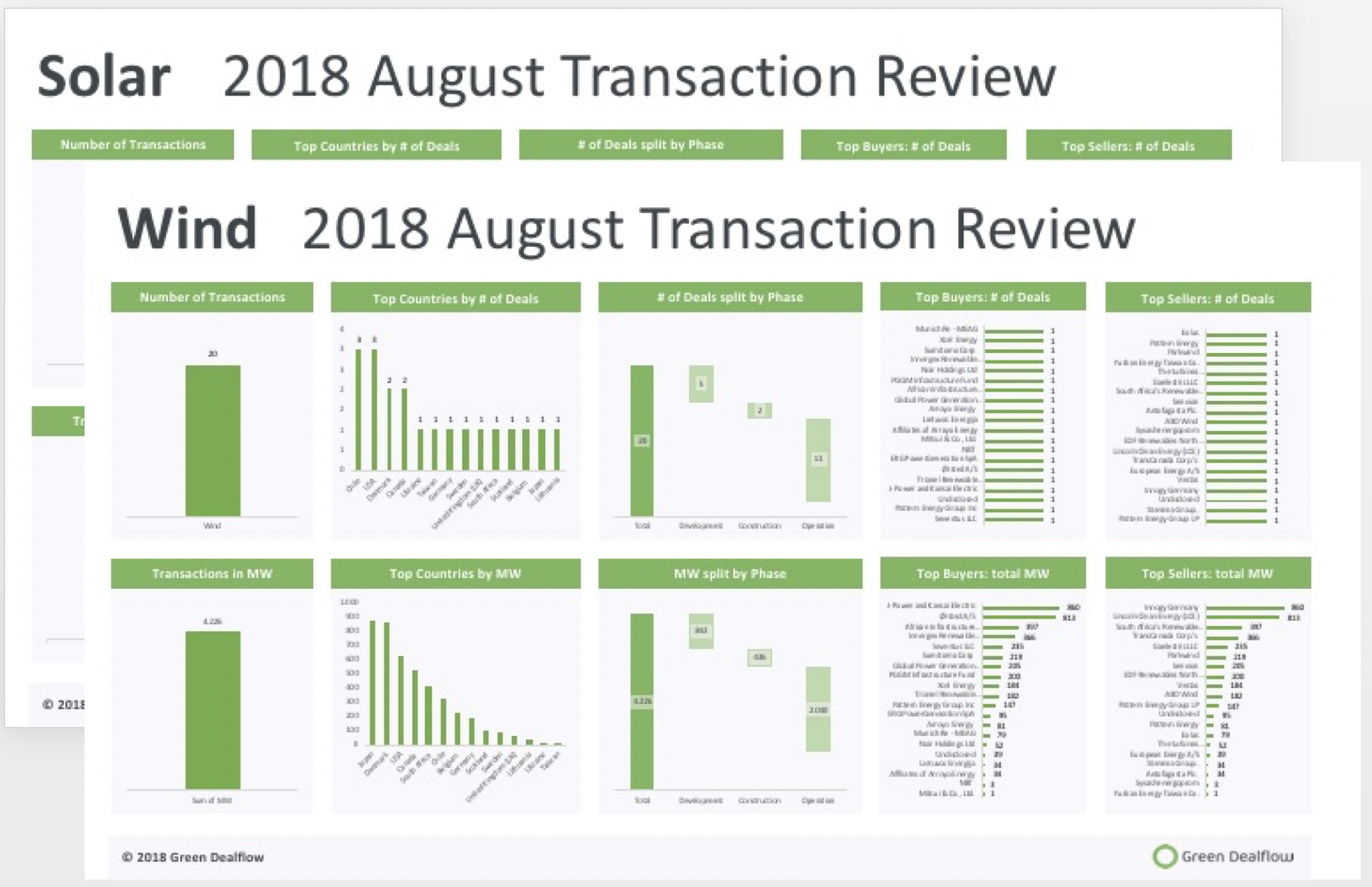

As for the wind industry, the report records 20 transactions amounting to almost 3.3GW in gross capacity transacted. After April with 15 transactions amounting to 5.7GW, the trend remained negative in May for wind energy deal flows. The USA were again in the leading position regarding total MW transacted with 5 transaction of more than 1.6GW, mainly due to the Ontario Teachers’ Pension Plan selling its 100% shareholding in Canadian renewable power producer BluEarth Renewables LP to a fund owned by Dutch fund manager DIF. Calgary-based BluEarth focuses on the acquisition, development, construction, ownership and operation of wind, hydropower and solar parks in North America. It has 333 MW net under construction or in operation in its portfolio and an additional 1,000 MW under development.

Spain was in the second place with 2 transactions of 509MWmainly due to French investment fund Ardian buying a 420MW wind portfolio from Spanish renewables group Renovalia in a 550-million-euro deal.

The UK took the third place regarding total MW transacted with 1 transaction: The renewables arm of German diversified group BayWa AG taking over the UK renewable energy business of Forsa Energy Ltd, including a 350-MW pipeline of Scottish onshore wind projects. The total capacity in comparison to the previous month went down by approximately 43%.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.