Given the increased investment costs due to raw material prices of photovoltaic and wind plants (capital-intensive capacity), it is increasingly advantageous for developers to sign PPAs, securing the projects´ bankability.

In fact, it is convenient that the cash flow of a new big plant coming online is known in advance, otherwise, it will be more challenging to secure initial financing and the conditions of financial stability necessary to proceed with the investment. The PPA allows for immediate revenue forecasting by contracting for it.

PPAs are purchase contracts concluded between an owner of energy production plants and a buyer at a negotiated price, which can be:

· fixed, in order to contain the effects of the volatility of the energy price

· indexed to the zonal price with or without the possibility of fixing

· variable, perhaps with minimum and maximum values according to the trend of the electricity market; alternatively with the provision of a margin sharing.

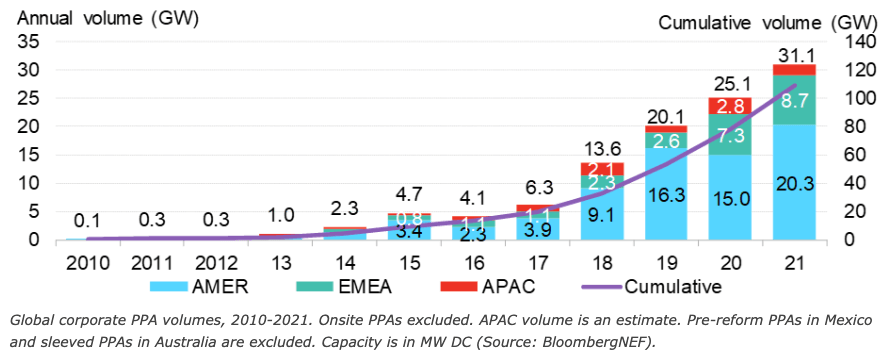

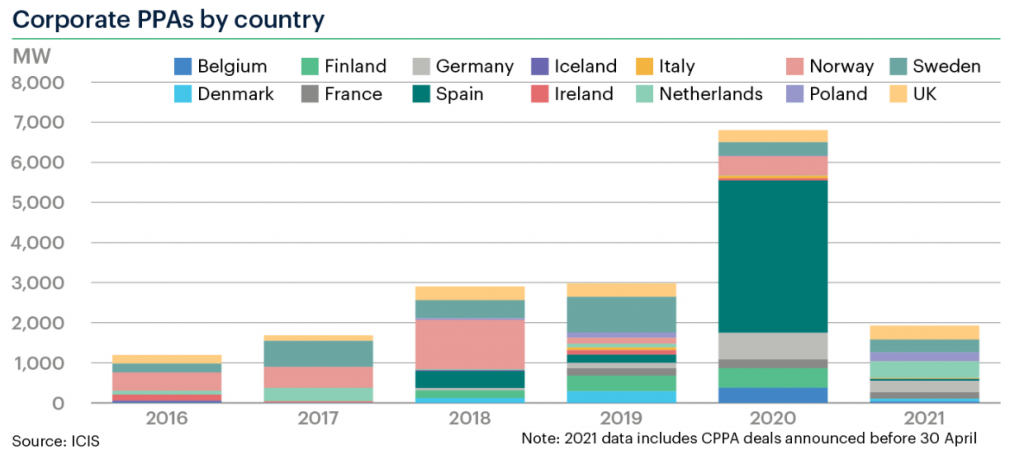

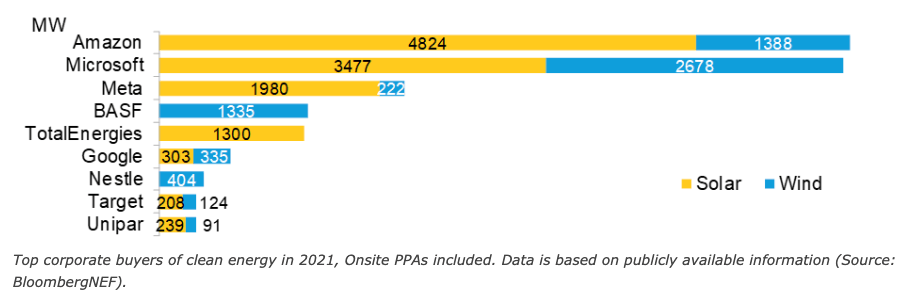

The PPA market is expanding fast, especially across the U.S. and European countries, with more details shown in the figures below.

It is crucial to understand which kind of PPA is possible to negotiate according to the expectations of each buyer to get the most suitable option for each organization.

What types of PPAs exist?

Physical PPA

Through an energy retailer, who provides the energy from the renewable asset, the developer sells the renewable energy to a final consumer. Any gap is filled from the generation portfolio of the retailer. The customer receives a single bill for all of its consumption at the end of the month.

Virtual PPA (VPPA)

To negotiate the price of the PPA, the consumer speaks directly with a renewable energy developer. The energy retailer bills the consumer for its actual energy consumption at the end of each month with the information regarding the difference between the spot price and the agreed-upon PPA price. In addition, the consumer receives guarantees of origin from renewable energy sources.

Then, you can allocate energy risks under different PPA structures. Two of these are:

As-produced PPA

It assigns the buyer some volume risk, but the seller is responsible for overperformance or underperformance, due to the unpredictability of renewable sources.

Baseload PPA

This kind of contract guarantees a constant amount of energy each hour of every month, a monthly baseload contract bears the volume risk on behalf of the seller.

For renewable energy plants without an incentive system, PPAs are a very interesting tool that might see a rise in the market, given the advantages provided on both sides of a contract and the current energy crisis under which Europe is at the moment.

Green Dealflow is an exclusive matchmaker for professional investors and project developers in the solar and wind industry. For developers, we provide the service of introducing the relevant investors or PPA off-takers for their projects within 2-4 weeks (off-market with discretion). Other services we provide to the developers are secure data room service, financial modelling service, running a structured process to sell projects etc. For investors, we provide the project based on their investment criteria and run an RPF process to source projects in any market as a mandate holder. Further to this, we deliver renewable news and trends, blog posts, and business intelligence, e.g. through transaction reviews etc., to our client base periodically. Remember to register your interest with us.