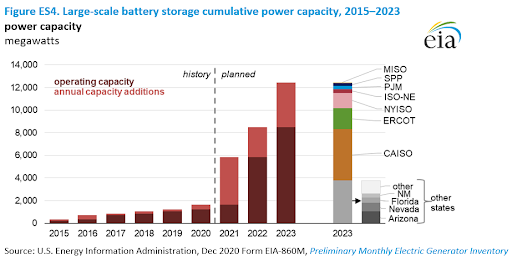

Lithium-based energy storage volumes in the U.S. are expected to grow by multiple orders of magnitude in the coming years, with a 1000% capacity increase by 2023.

You can see the original article here.

Lithium-based energy storage volumes deployed to the United States will grow by multiple orders of magnitude in the coming years, with a 1,000% capacity increase over the next two years projected in a recent government report. That rate of growth may well be an underestimate, given current market trends.

The U.S. Department of Energy’s Energy Information Administration released the third edition of its U.S. Battery Storage Market Trends report, covering a mix of energy storage information from the end of 2019, and 2020, with projections through 2023.

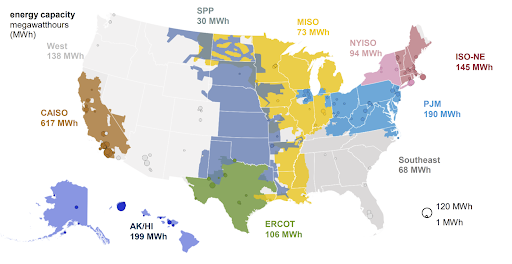

EIA, 2019, MWh of Energy Storage per Region

The EIA noted that as of the end of 2020, 74% of the nation’s slightly more than 1 GW/1.8 GWh of energy storage was deployed in five states. California contributed 31% of that total. Texas, Illinois, Massachusetts, and Hawaii accounted for more than 50 MW of capacity each. The report predicted a rapidly growing, evolving market as a result of consecutive reductions in future pricing.

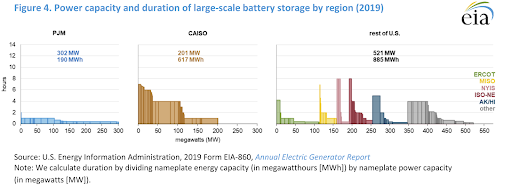

As of the end of 2019, it was clear that market location was driving energy storage installation techniques.

In PJM territory, batteries are most often used for ancillary services, so installations tended to be “power oriented,” delivering a higher instantaneous power output for a shorter duration. Installations in the power grid region had an average power capacity of 10.8 MW, and an average energy capacity of 6.8 MWh, meaning an average duration of 45 minutes.

In California, batteries were being used primarily for stability. The state’s batteries had an average power capacity of 4.7 MW, and an average energy capacity of 14.4 MWh, making for an average duration of just over 3.0 hours.

The longer hour pattern has continued in California, with a recent announcement noting that 2 GW of energy storage power capacity was due online by the end of August. Most of that will be coupled to 4 hours of energy capacity.

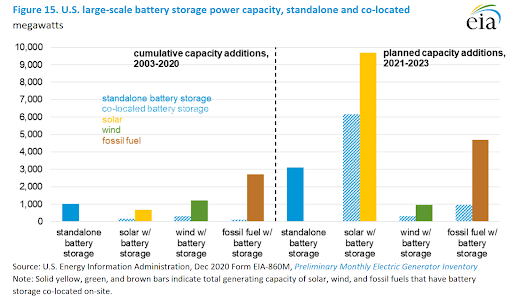

Going forward, the volumes are growing with at least a 1,000% capacity growth over 2019 numbers expected.

Project developers had reported to the EIA that they planned to install over 10 GW of large-scale battery storage power capacity between 2021 and 2023. While the EIA doesn’t publish forward-looking energy capacity volumes due to privacy requests by developers, WoodMac Renewables & Power has suggested that around 12 GWh of capacity is on track to be installed in 2021.

The report noted that California accounts for 40% of power capacity planned between 2021 and 2023. These planned additions put California in line to meet its energy storage requirement by 2024.

California will already have 2 GW of energy storage power online by the end of August. Given the state’s power grid challenges, expectations are that the state’s storage capacity will continue to grow very aggressively, blowing past their legal requirements.

The EIA report also said that greater than 70% of the energy storage to be deployed is slated to be coupled with solar power. This would increase the current volume co-located with electricity generation from 30% to 60%.

Current tax law makes it so that coupling solar power and energy storage gets a 26% tax credit and accelerated depreciation (roughly another 17% of project costs) applied to the energy storage if the solar power is used to charge the batteries.

Industry has been pushing for its own energy storage tax credit that would decouple the solar+storage relationship, at least financially. Recent reporting by the National Renewable Energy Lab shows that coupling storage with a standard solar installation produces only modest price savings, if any.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can crematchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.