Developing a project in some countries allows access to an additional income stream through carbon finance mechanisms of which the market is looking at with more and more interest.

Carbon markets emerged in the 1990s as an instrument of tackling climate change by funding carbon mitigating initiatives that generate carbon offsets. A carbon offset, or carbon credit, is a tradable unit that represents one metric ton of greenhouse gas emissions reduction or removal, measured in CO2 equivalent emissions (tCO2e). Companies offset emissions either because they are demanded to – thus participate in compliance markets – or as a voluntary effort, hence the appearance of the voluntary carbon market.

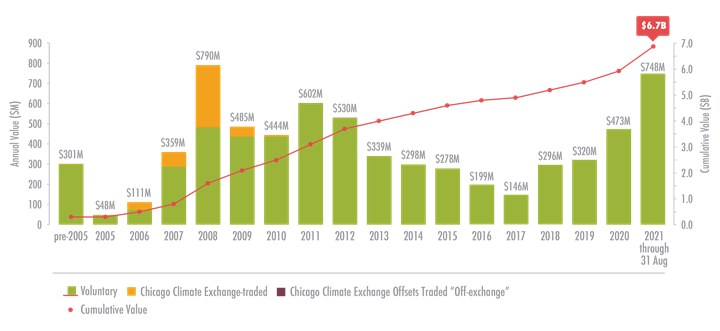

The latest report by the Ecosystem Marketplace found that, as of August 2021, the voluntary market valued at $748 million. If current levels continue, it is expected to hit $1 billion by the end of the year, a potential historic record. Volumes traded in 2021 are already 27% higher than 2020, which itself presented a growth of 80% in comparison to 2019. Renewable Energy projects alone accounted for over half of the credits issued in 2020.

Ecosystem Marketplace, 2021

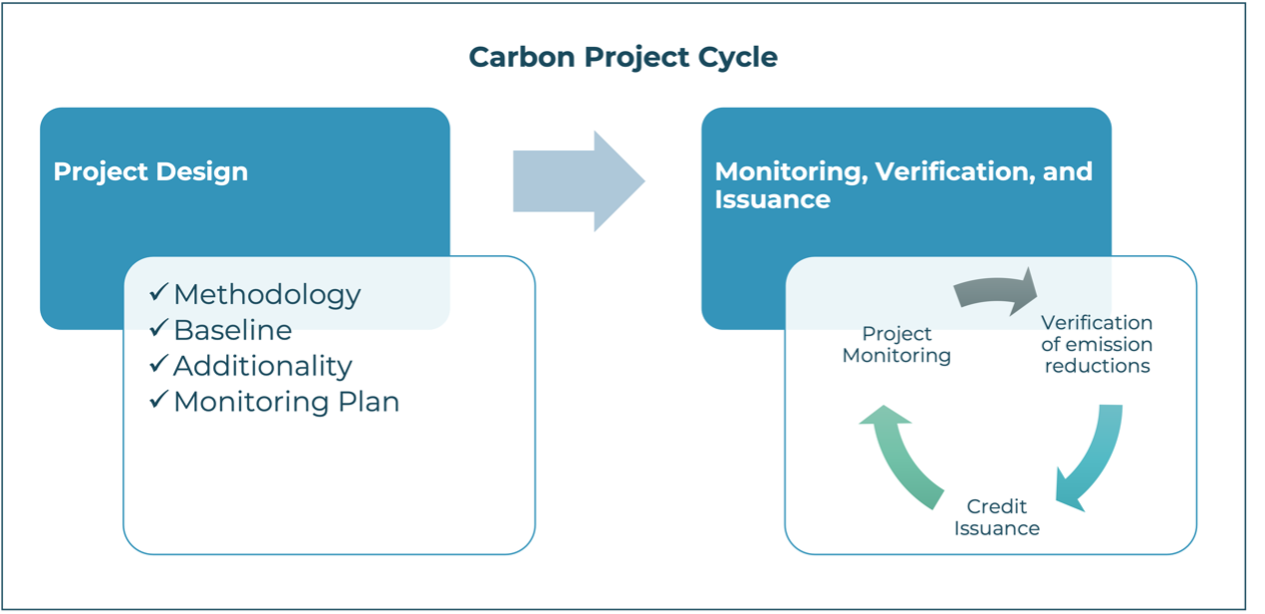

Projects that are able to issue carbon credits must be registered at a recognized standard, such as the Clean Development Mechanism, the Verified Carbon Standard, the Gold Standard, or the Global Carbon Council. Each standard has its own set of guidelines and requirements, but typically a carbon project cycle contains two main stages: (1) design and registration; and (2) periodic monitoring, verification, and credit issuance.

During project design, a project developer will establish all the relevant operational and technical aspects of the carbon project. Generally, the first step is to select a methodology of quantifying greenhouse gas emissions. Standards have a list of approved methodologies that are applicable to solar and wind projects that can be grid-connected or stand-alone systems. Most of the methodologies were actually developed by the Clean Development Mechanism, such as “AMS-I.A. Electricity generation by the user” or “AMS-I.D. Grid connected renewable electricity generation”.

An essential component of the methodology is the determination of the project baseline. The baseline of a carbon project is the most probable scenario that would have taken place in its absence. Consider the installation of an on-grid solar plant in a country where thermal plants are predominant. In this case the baseline scenario would probably be the construction of another thermal plant. The emissions avoided are those produced by the country’s electricity grid – calculated by multiplying the energy produced by the plant by the grid’s emissions factor. Methodologies will provide a framework for obtaining the emissions factor, and some countries already calculate and disclose this value.

The idea of a project baseline is intimately connected to another fundamental aspect of project design – additionality. A project developer must demonstrate that the emissions reduced by the project are in fact additional - i.e., would not have occurred in the absence of carbon revenue. The most common way to prove additionality for renewable energy projects is to demonstrate an investment or financial barrier. Usually, a project developer will show that carbon revenue was considered fundamental for the implementation of the project since the beginning of its conception. It may be more difficult to advocate for a project’s additionality in countries with more advanced penetration of renewable technologies.

The last important pillar of project design is the monitoring plan. Project developers must inform on how they intend to monitor, record, and ensure the quality of all the data relevant to the calculation of carbon offsets, including a description of the organizational structure and the personnel that will be involved with the project. This is crucial to ensure the transparency and accuracy of the reduced emissions.

Project design, methodology, baseline, additionality, and monitoring plan are all described in a single document and submitted for evaluation. Once the project is validated by an independent auditor as well as the standard’s certification body, it is considered a registered project.

After registration, projects undergo a monitoring period that is also verified by a third-party auditor to ensure that emissions were reduced as planned. Once a given period is verified, the project developer may claim carbon credits for that period and trade them as they wish. This monitoring and verification cycle repeats itself every time a developer desires to issue credits for the lifetime of the carbon project, which may vary from 7 up to 21 years.

Besides greenhouse-gas abatement, carbon projects may also demonstrate that they bring additional environmental and social impacts to the community, sometimes referred to as co-benefits. In fact, standards have given an increasing importance to co-benefits, and some have even included the reporting of sustainable impacts as a requirement of the carbon project. In addition to promoting sustainable development goals, co-benefits may increase the attractivity of a project’s credits in the voluntary marketplace, as companies often purchase offsets to promote their sustainable agenda.

Carbon finance is particularly relevant to renewable energy projects located in countries where access to the required finance and technology still represents a significant barrier to energy transition. Indeed, according to the same Ecosystem Marketplace study, these types of projects are expected to have a steady participation in the voluntary market.

About the authors:

Pedro Carvalho is a Policy Consultant at EcoSecurities, a global leading firm on environmental markets, that helps project developers to monetize environmental assets arising out of carbon projects or renewable energy plants.

Maria Haniya is an Environmental Engineer-to-be and assists in the development of carbon projects at Ecosecurities.

Green Dealflow – is a matchmaker for professional investors and asset owners in the solar and wind industry. You can create a free account and search for assets to invest in, or ask us about off-market projects, find investors for your projects with discretion (off-market), or PPA Off-takers can look for business partners on a “no cure – no pay” basis. Further to this, Green Dealflow delivers news, blog posts and business intelligence, e.g. through a transaction database and monthly reports.