During the past three years as a mediator between asset owners and investors in the renewable energy sector, Green Dealflow witnessed a high level of process inefficiency and miscommunication that was caused by unsubstantial solar project teaser. We realised something had to change and asked ourselves and some investors in our network:

-What does a solid project teaser looks like?

-Which information is relevant to investors?

-How should a solar project teaser be structured to facilitate transactions?

Based on our extensive knowledge in the financing of renewable energy projects, we designed a new teaser for both Wind and Solar projects which are now available on our platform. The aim of the new structure is to make it simple for asset owners to provide investors with relevant information about their project. A convincing project teaser often represents, just like an appealing business card, the starting point of fruitful business partnerships. If the information is complete, credible and up-to-date, the teaser will allow quick and efficient match-making between the asset owner and suitable investors.

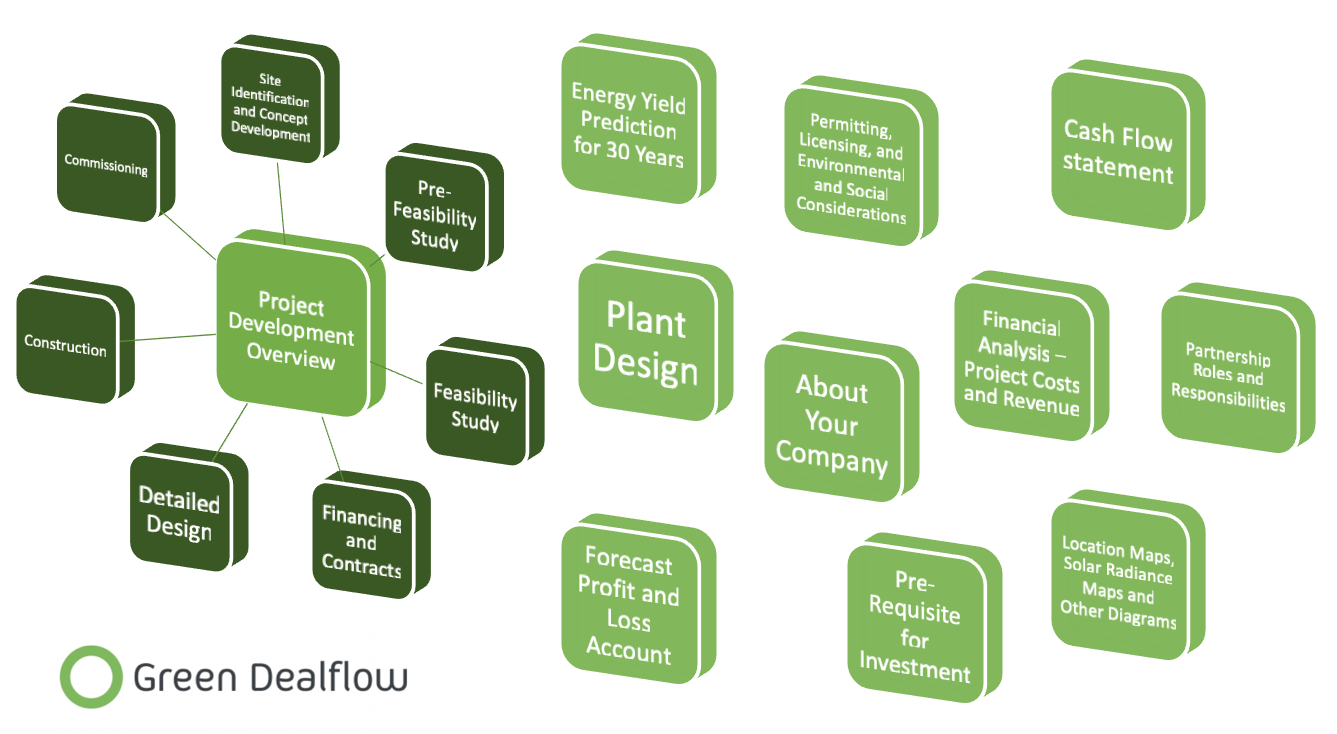

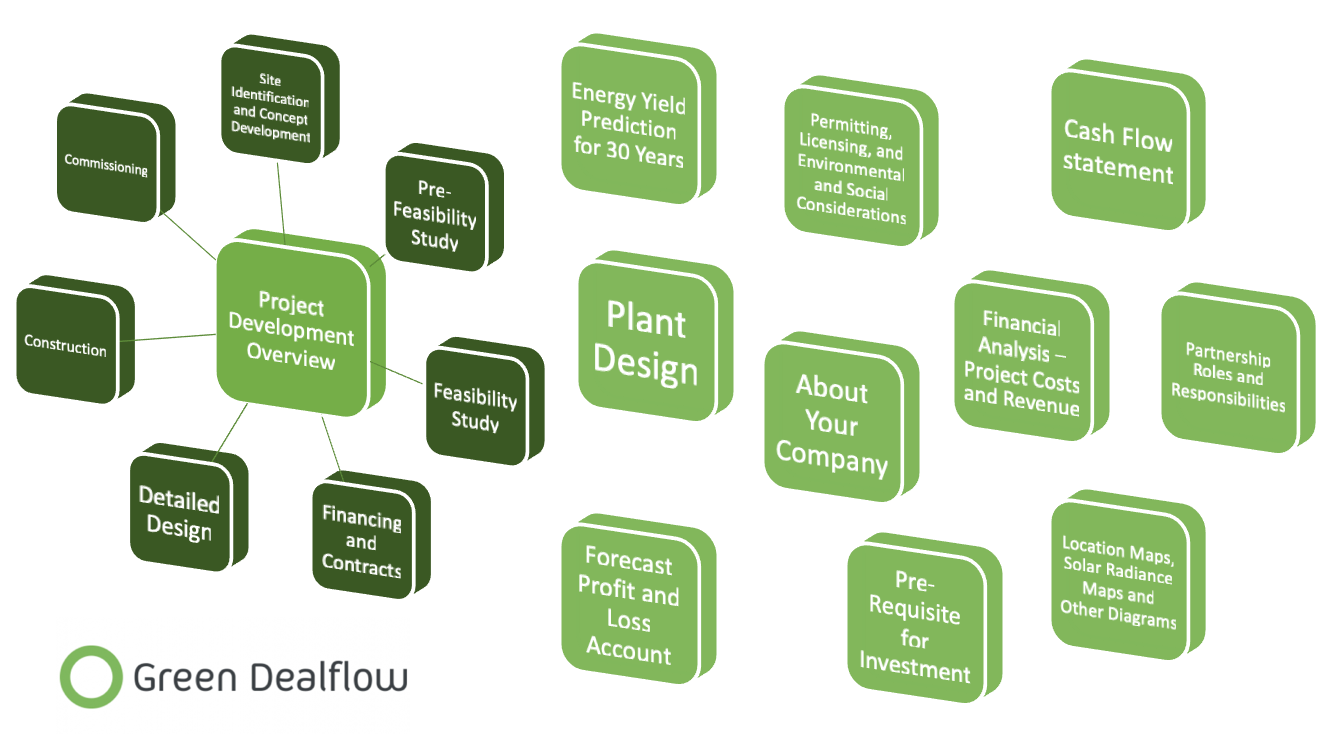

For Solar, we identified 11 crucial elements on which we based our new template for a solid teaser which has the potential to attract keen investors (Figure 1).

Figure 1 – The 11 crucial elements of a solid solar project teaser

The teaser starts off with an overview of the project development. The purpose of this first section is to introduce the investors to the project development process, from the inception of the idea to the start of commercial operation. The project development process is contingent upon many external factors. However, at Green Dealflow, we consider the project development process as certain activities that need to be completed and which can broadly be organized in the five stages;

- Site identification and concept development.

- Pre-feasibility study.

- Feasibility study.

- Permitting, financing and contracts.

- Engineering, construction and commercial operation.

The first two parts of Section I are relevant to owners of assets in the Development or Operation stage. The first consists of Site Identification and Concept Development and considers the project structure, evaluates suitability of the site (f.ex. constraints) as well as regulatory support (such as tariffs) and grid access. The second part of the first teaser section conducts a Pre-feasibility Study which assesses the access permissions, restrictions, the conceptual design, requirements, expected costs and a review of conditions for PPAs and electricity tariffs.

The Feasibility Study and the Financing/Contracts concern owners of Ready-to-Build and Operation assets. Both parts request the asset owner to fill in dates of the occurrence of specific events such as the assessment of the Capex for technology and supplier options or the signing of the grid connection agreement.

Detailed Design, Construction and Commissioning represent the last three parts of Section I and are only addressed to projects that reached the Turn-Key or Operation stage.

Section II gives an overview of the Energy yield prediction for the next 30 years. Here, the asset owner should aim to provide the investor with an estimated but realistic amount of electricity outcome over the lifetime of the solar asset.

Section III investigates the Plant Design, in particular the selection of PV Modules, invertors, transformers and mounting structure. The asset owner has to ensure the compatibility with the national grid regulations and that the product and power warranty terms and conditions are in line with the market standards.

Section IV takes into account the Permitting, Licensing and Environmental and Social Considerations. This section seeks to assess whether all required permissions regarding the environmental and social dimension have been received.

Section V represents a Financial Analysis and examines the commercial viability of a Solar PV project by considering the expected costs, investment requirements, O&M costs, and revenues.

Section VI explores Partnership Roles and Responsibilities and allocates different tasks to the developer or the investor – from Development Funding to EPC.

In Section VII and VIII asset owners are asked to attach an estimated Cash Flow Statement and a Forecasted Profit And Loss Account to provide interested investors with detailed information on the profitability of the undertake.

The Pre-Requisite for Investment in Section IX investigates both the object of purchase (f.ex. development rights, EPC, O&M Contracts, etc.) and the cost structure.

Section X of the template is reserved for contributions about the asset owner’s company and previous experience. Any information which contributes to the credibility of the project (e.g. senior management, track record) is valuable here.

The last section allows the asset to include specific geographical characteristics of the asset into the teaser such as locations maps, solar radiance maps, electrical interconnection diagrams, substation diagrams etc.

The first impression is crucial, hence it is important to have a high-quality teaser for a project as investors use it to determine whether they will consider investing or not.

Green Dealflow’s new teaser templates aim to support asset owners to provide investors with relevant and well-structured information at any time. We hope this will result in less redundant communication, increased transaction efficiency, and give rise to more fruitful business relationships in the renewable energy sector.

You can access the new teaser templates after you logged in under >My Account >Teaser Templates or provided you are already logged in by clicking here.

Green Dealflow is a global matchmaker in renewable energy: we connect asset owners with trustworthy investors in wind and solar industry, all around the world. Create a free account today and stay updated on new projects and the latest renewable energy news and trends!